Unbelievably, today marks 10 years since an anonymous internet user posted a whitepaper to his idea called “Bitcoin”. Back when whitepapers were thought of as a colloquial term of toilet paper, “crypto” referred to cryptography, and Paypal ruled the internet’s money. It is astounding to think how much has changed.

A user utilizing the pseudonym “Satoshi Nakamoto” posted to a cryptography emailing list a link to his white paper, which outlined a project he had been working on for what was obviously quite some time: Bitcoin.

You can find the original emails from the cryptography mailing list in this tribute website here, and of course the original whitepaper still sits on Nakamoto’s original domain “Bitcoin.org” here. (Note: Not Bitcoin.com!)

I’ve done a number of talks on the incredible revolutionary aspects of Satoshi’s project. Of course, that’s what it is… a project. A project with a very real purpose. But it is clear to anyone who does enough research that Bitcoin was not in any way a get-rich-quick scheme. This was purely a project to create an exchangeable digital asset, that could be traded for value, just like you would trade your collectable Lego for baseball cards. What that value is is determined entirely by the market. What are people willing to pay for a Bitcoin? Whether it should be $100 or $10,000 is entirely determined by the price people are willing to pay. And the more it can be used the more people will want it. And the fact that there is a limited supply means its value can at least be capped.

Back to my talks… I have done a few on Bitcoin and its underlying blockchain technology made famous by Nakamoto in the early days. Having written about Bitcoin back when it was worth $100 (one day I’ll tell you about how much I bought back then), and now speaking about it since taking the reins here at Global Crypto, I’ve found myself regularly enamoured with this global project that is Bitcoin. No matter how much I want to talk about other opportunities the blockchain presents us, I can’t help but bring Bitcoin up in that conversation.

And in most of these talks, I raise a few of the revolutionary points about Bitcoin that I think are pertinent on a day like today. They provide a nice little summary for what Bitcoin, its whitepaper, and its ideals are all about.

So… happy birthday “Bitcoin whitepaper”! Here’s what you’ll learn about Bitcoin if you read it…

1- The currency is decentralized

And yes, it is a currency. As much as I prefer the term “cryptoasset”, technically it’s also a currency: Something you can trade in return for something else deemed valuable.

And this was the first decentralized currency since before governments, monarchies and central banks took control of the likes of gold, water and grain back in ancient Egypt.

Like the internet can never be shut down, Bitcoin can never be shutdown. Like the internet is a data transmission protocol, Bitcoin is a protocol. Every single computer on the network carries an exact copy of the entire protocol and its history (currently 175gbs), and to date there are over 10,000 computers that are running this exact protocol. And even if all 10,000 (in remarkably varied locations across the globe) were compromised, you’d still be able to restart a new protocol based on Satoshi’s ideas in the whitepaper (as the 2000+ other cryptocurrencies already have).

No-one controls this protocol, except the community itself. In order to make changes to the protocol, the community need to be in consensus – ie. majority vote. If the minority doesn’t like the direction, they can fork the protocol and start their own project (like Roger Ver and Bitcoin Cash did). The majority of the community carry on building the original project.

Anyone and everyone are free to join, participate and vote on this project.

2- It was designed for direct peer-to-peer, internet transactions

There had never been a digital form of value you could trade directly with someone else over the internet. You could email directly, peer to peer. But then that email could be duplicated and copied to a million other users. It wasn’t value, it was communication.

Bitcoin solved the digital duplication problem by preventing replication of transactions, so when I sent you Bitcoin, it stayed with you until you decided to send it on.

And it was truly peer to peer. All you needed to receive my Bitcoin was the Bitcoin protocol, or in simple terms: A bitcoin wallet. No-one and nothing else was required to transact digitally. No passwords, no subscriptions, no sign up fees, no permission. Anyone could (and can) get the Bitcoin protocol on their computer, and begin transacting. No control by any third party.

3- It’s a deflationary currency

Nakamoto wrote into the protocol that there can only ever be 21 million Bitcoins. In his whitepaper he referred to the scarcity of gold, and just like the famous yellow commodity is a scarce resource, Bitcoin would be limited in supply too.

And just like gold gets more and more difficult to mine the more you dig up the ground in which you find it, using a “proof of work” algorithm, Bitcoin gets more difficult to mine the more computers try and plug into the network to try and mine it – thereby limiting the supply into the marketplace, and keeping the price in line with the number of users wanting to buy it. Genius economics.

This is revolutionary in its idea: Because every other currency in the world can be increased in supply by their respective governments. And not only “can be”, but have been! This is called “inflation”. If there used to be only 1 million US dollars in circulation, there are now trillions of dollars in circulation. And we wonder why 1 US dollar bought you a car 100 years ago, and today it doesn’t even buy you a dinkie toy car.

4- It’s a giant ledger

All Bitcoin is in essence is one giant ledger of transactions. Like any bank’s accounting ledger that holds the record of where every customer’s money has come and gone, Bitcoin is a gigantic ledger recording every single transaction that happens on its network. And at the time of writing, a total of 175 gigabytes of transactions! That’s a lot of transactions.

5- This ledger is immutable

Here’s where things get different to a normal bank: you cannot change the ledger. Technically, a bank’s manager could adjust the Excel spreadsheet when sending it to the tax man for auditing purposes. And we know this has happened regularly. From government central banks to the world’s Top Six banks, ledgers have been adjusted throughout history to keep chaos from ensuing (as they attempt to hide their corrupt transactions).

Bitcoin on the other hand solves the corruption problem by saying “no one can change it”. It’s immutable. Or “unchangeable”. Once a transaction happens on the network, the record of that transaction will remain forever. If a government official is trying to move stolen government funds to another country, best they don’t use the Bitcoin network to do it.

6- This ledger is open

Anyone can see this ledger, at any moment. As long as it takes your computer to process a giant Microsoft Excel Sheet, and as fast as your internet speed is, you can run through the entire Bitcoin ledger and see where all the Bitcoin is. It is free for anyone to see.

And remember: This ledger is perfectly replicated on every single computer running the protocol, so you’re always guaranteed to get the right one. Every time a transaction takes place on the network, that transaction is broadcast to every computer running the protocol, who then record it in their ledger, in exactly the same way – these computers are then talking to each other to confirm they all have the same transactions and information.

Sure, this means the network can currently only process about 7 transactions per second. But what you get in return (accountability, deflation, international transactions) far outweighs the inconvenience of immediate payments! (And when I say “immediate”, remember: A Bitcoin transaction still only takes about 30 minutes to process – compare that to the two-day foreign exchange controls you have to get through when sending Pound Sterling to Australia!)

Nothing is hidden in this open society. If you want to do drugs, do it. But know that everyone can see. Ok, that’s a little extreme of an example, but you get the point.

7- The author of the whitepaper remains anonymous

To this day, no one knows who Satoshi Nakamoto really is. Some speculate he’s actually a woman. Others speculate he’s a team of people (where my opinion lies). Still others speculate he’s a Japanese mathematical genius as his pseudonym (and he himself) implies. Whoever they are, they have created one of the world’s greatest technologies in the blockchain (true distributed ledger technology aka blockchain has Nakamoto to thank for its utility existence).

Think about the anonymity for a second. If you were going to create the next “big thing”, wouldn’t you want everyone to know you were the one who came up with the idea? I mean, how many times have you said to a friend: “I heard about One Direction before they became famous!”

Us humans love recognition, even for the most menial things. And yet Satoshi wanted none. He realised how important an economical idea Bitcoin was, and realised it was best he didn’t reveal his true identity. Doing so could manipulate the price, the integrity of the protocol, people’s opinions of it based on their opinions of him or her. He realised it was bigger than him, and it was best no-one knew who he really was. Humility on every level.

On top of this: Did you know that Satoshi was the first person to mine Bitcoin? Well, it makes sense now, doesn’t it? When the protocol first went live in January 2009, he was the first person to mine it. His good friend and co genius Hal Finney then joined him a few weeks later. But do you know how much Bitcoin Satoshi mined in total?

980,000.

Now. Remember I told you the protocol is based on an “open, immutable ledger”? Well guess what?

Satoshi hasn’t touched those 980,000.

Ya. Take that in.

You’re desperate to get your hands on 1 Bitcoin. He has access to 980,000. And hasn’t touched ONE.

His Bitcoin wallet that he mined his original Bitcoin to still holds the full 980,000 he mined in the first 3 years, and he hasn’t touched any of it. 10 years later!

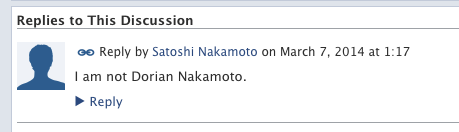

Satoshi went off the grid with a final post on 28 April 2011, but seems to have popped up using the same email and user accounts to ensure people understand he is not who others speculate he is (see screenshots below with links to original posts).

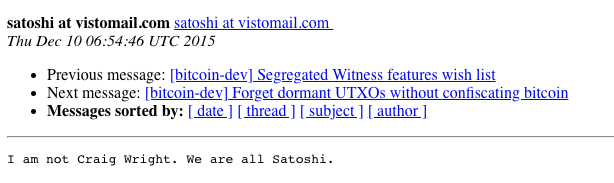

And then again in 2015:

8- The author did not copyright the information

In a very similar vein as the above point, and in keeping with the ideals that he proposed, Satoshi not only didn’t copyright or patent his work, he didn’t even entertain the idea. Satoshi believed in an open future, a society whereby people could share ideas freely and live in honest trust of one another, instead of “limited supply thinking” and that ideas had to be protected at all costs.

Unlike the mega corporations of today, Satoshi recognised that the best ideas are best when shared with the world, and built upon. And indeed his idea has been built upon! Currently at over 2000 other blockchain-based cryptocurrencies, Satoshi’s blockchain idea has become the most talked about thing on the internet since the internet itself. And he was never afraid someone might come up with a better idea. Many would argue there are already better blockchain ideas, like Monero, Ethereum or even Bitcoin Cash? But that’s the point: A free idea means progress: A true open society within which anything can be improved upon, and evolution can take its course.

— – – – – – – – – –

So as you can see, from these 9 points alone, we are dealing with one of the great inventions the world has ever seen. Built upon some of the best cryptographic technologies in the world (like haschash, digital signatures and merkle trees), the Bitcoin whitepaper introduced a conglomerate of cryptography that has became the standard in true digital assets.

Not wanting to get rich from it, and only wanting to make the world a better place, Satoshi Nakamoto gave the world a gift on 31 October 2008.

Best we steward it wisely.