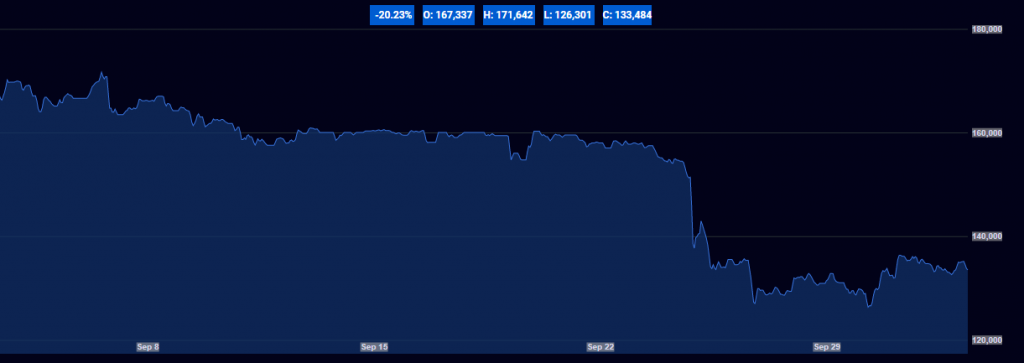

The price of Bitcoin has dropped 20% in the past month, with the largest intraday price drop of 18% taking place last week Tuesday, 24 September. The current price is R133 196 having recovered slightly but still lower than the price of R168 152 achieved on 3 September. Luno, South Africa’s most popular cryptocurrency exchange, unpacks some of the reasons for this fluctuation.

Marius Reitz, Luno’s GM for Africa, says that while volatility is par for the course in cryptocurrency, there are several reasons for the price volatility. “Bitcoin and other cryptocurrencies have great potential to be effective tools for storing, maintaining and exchanging value – this hasn’t changed. In fact, people in South Africa are buying cryptocurrency for the first time every day despite the drop in prices.”

There are four main reasons affecting the price:

Short term traders – The crypto price is still dominated by short term traders with most price action being driven by short term technical analysis.

Negative sentiment is affecting all asset classes – The main reason for the drop in Bitcoin’s price has been the negative sentiment across all markets caused by the global geopolitical news flow. This has impacted all asset classes and has happened at a time of low liquidity which has led to volatility. When there is more liquidity and markets become more risk-averse, there is still money going into safe-haven assets like gold and yen. Many of these investors have placed a small amount into Bitcoin as a hedge. However, even safe havens are struggling to find buyers. Bitcoin slumped last month and gold has also dropped in the last 30 days.

Potential impact of new exchange – Bakkt, a long-awaited platform for trading Bitcoin futures, opened on 22 September amid hopes the exchange would attract more buyers to cryptocurrencies, with some anticipating an institution-led bull run. Bakkt volumes have been lower than anticipated and the sharp decline in crypto prices has been linked to this disappointing start.

New asset classes can be more volatile – Cryptocurrencies are a new asset class, so there will always be a higher level of volatility compared with traditional trading. However, as the benefits of cryptocurrencies become clear, more people and businesses will hold the coins for their utility value, which will reduce speculation and limit volatility. As regulation is introduced and the functionality of cryptocurrencies increases, the true price will become more consistent.

— – – – – – – – – – – – – – – – – – –

This article is an Opinion Piece received from Luno. Global Crypto did not receive any form of compensation for its publication, and as this material is deemed newsworthy for the Southern African blockchain industry, it was thus published accordingly.