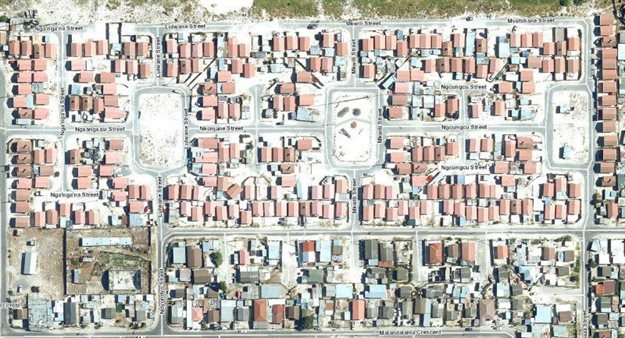

The Centre for Affordable Housing Finance in Africa (CAHF), research consultancy 71point4 and Seso Global have partnered to develop South Africa’s first blockchain-based property register. The pilot study area consists of almost 1 000 properties located in four sites in Makhaza, Khayelitsha. All the properties are Government subsidised properties that have not yet been registered on Deeds Registry.

According to Daniel Bloch, the CEO of Seso Global, a blockchain property registry company, this will be the first working example of a blockchain-based property registry in South Africa. Aside from creating an immutable record of who owns which house, the Seso platform facilitates and records transactions such as sales and transfers out of deceased estates and integrates with third parties who facilitate transactions, including mortgage lenders. “For the time being, property owners will record these transactions at the Transaction Support Centre, a walk-in housing advice office created by CAHF and 71point4 located in the area. But over time, we will record transactions through the Seso app” says Bloch.

The benefit of the blockchain solution is that it allows the data to be stored in a decentralised, secure database that can be updated without any loss of historic data. This means there is a secure, back-to-back record of all transactions that is completely tamper-poof. Eventually the vision would be to integrate this record into the Deeds Registry when other impediments to transfer have been removed.

South Africa has a serious titling problem. According to Kecia Rust, the CEO of CAHF, the government has built over three million RDP houses since democracy. But CAHF’s analysis of deeds office data indicates that only 1.9 million of these properties have been registered. The National Department of Human Settlements, Water and Sanitation (NDHSWS) estimates that the title deed backlog for RDP properties built prior to 2014 currently stands at 511 752. These properties were given to beneficiaries, but no title deeds were registered and handed over. At the same time, there is a backlog of 351 470 title deeds on newer properties.

Registering these properties so long after they were built and handed over to subsidy beneficiaries is an administratively complex task. In some cases, original subsidy beneficiaries are no longer living in the properties. Some beneficiaries might have passed away, some might have tenants in their properties while others have sold their houses informally.

“To create a register of property owners we first had to go door to door to find out who lives in each property and to establish how they came to be there” says Melzer, founder and lead consultant at 71point4. “We hired a team of 17 enumerators and trained them to collect information and capture supporting documents. Thankfully we can leverage smart phone to collect the data, but it still requires a significant effort. It took us two months to cover these areas.”

But the effort is well worth it. Properties in the area sell for over R200 000 informally – and would sell for more if they were listed on a trusted registry and were ‘bankable’. This would enable buyers to obtain mortgage finance and create affordability. Without access to mortgages, buyers have to pay cash for a house, or use an expensive unsecured loan. There are also significant benefits to the City of Cape Town of being able to access an accurate and up-to-date record of property ownership. Without it, the City cannot collect revenue from households in the area who are not indigent nor can City departments facilitate building plan approvals.

NEXT STEPS

In many cases in the pilot areas, the original beneficiary is still living in the property. “We hope that these properties can be registered in the deeds registry within a few months, and we are working closely with the City of Cape Town to facilitate that” says Melzer. “Where the beneficiary no longer lives in the property, we are in the process of tracing the beneficiary to confirm information we have gathered on who owns the property. We will also be working closely with the City on a resolution process where ownership is disputed.”

It will take some time before all the required information has been collected and validated. It will also take time for validated properties to be registered on the deeds registry. In the meantime, we will enable property owners and occupants to keep those records up to date.

“We will also be using Seso’s platform to manage other client service requests that come to the Transaction Support Centre from all over Cape Town” says Rust. “These include helping clients to regularise informal sales and wind up deceased estates. Going forward, as the country moves towards an electronic deeds registry, we hope the lessons we have learned will provide valuable evidence to inform the development of accessible, secure, affordable and efficient mechanisms to facilitate property market transactions. This is important across the market, but particularly in entry level segments of the market where existing mechanisms are simply too costly”.

CAHF, Seso Global and 71point4 have a working agreement to extend this pilot into other areas and use cases. There are hundreds of thousands of RDP properties around the country where no primary transfer has taken place. In addition, in many areas where title deeds were issued, property owners have transacted informally, which means there is no longer an accurate record of ownership at the deeds registry. Blockchain-based solutions can help there too. Blockchain can also enable households who live in informal settlements and rural areas to record and maintain land records and secure their rights. “We are very pleased with the pilot results. We think the solution we have developed is scalable, and replicable” says Bloch. That does not mean it is easy but, says Melzer “blockchain technology together the potential value we can unlock makes it worthwhile”.

— – – – – – – – – – – – – – – – –

ABOUT

The Centre for Affordable Housing Finance in Africa (CAHF)

The Centre for Affordable Housing Finance in Africa (CAHF) is a not-for-profit company with a vision for an enabled affordable housing finance system in countries throughout Africa, where governments, business, and advocates work together to provide a wide range of housing options accessible to all. CAHF’s mission is to make Africa’s housing finance markets work, with special attention on access to housing finance for the poor. CAHF pursues this mission through the dissemination of research and market intelligence, supporting cross-sector collaborations and a market-based approach. The overall goal of CAHF’s work is to see an increase of investment in affordable housing and housing finance throughout Africa: more players and better products, with a specific focus on the poor. More detail about CAHF is available on our website

71point4

71point4 is a Cape Town based strategic research consultancy specialising in consumer-focused, data-driven research in potentially transformative sectors. This includes housing, financial services and healthcare. The team at 71point4 uses a wide array of research methodologies and data sources ranging from big data to small, qualitative data to help our clients understand their customers and markets better.

Seso Global

Seso Global, a fintech firm, is building a trusted real estate market using blockchain technology to enable secured lending in emerging economies, where centralised land registry data can be unreliable.

The Transaction Support Centre

The Transaction Support Centre (TSC) is pilot action-research initiative established by CAHF and 71point4 to support secure tenure in low-income property markets. The TSC provides hands-on assistance and advice to individuals looking to transact through formal processes. At the same time the TSC documents the progress of transactions to highlight potential policy, legislative and administrative issues for attention. The physical advice office is based in the Desmond Tutu Sport & Recreation Hall in Makhaza, Khayelitsha, Cape Town and has been operational since July 2018.