I’m writing this article as the Coin Center Report inspired me to add some personal perspectives, given that I help Virtual Currency Businesses (VCBs) with their banking.

The truly mind-blowing thing about the report is that, when I first read it, I immediately thought: “wow, this is what I experience on a day to day basis while navigating the intersection between the Crypto & Fiat worlds on behalf of my clients”.

A few days later I took another look and noticed the report was published way back in May 2016! I read it in April 2019! Amazingly, things have not changed much, if at all. Just consider that for a minute… Think about what has happened in the Crypto space over the last 3 years and, for the same issues to still be present today is to, put it mildly, hard to believe.

Another aspect of the report which became clear on second reading was that the primary geographical region of the study was the USA. What I can say is that I’ve met with and spoken to founders of VCBs from all over the world and their experience is the same whether they are from the USA, a supposed Crypto friendly jurisdiction (Switzerland, Hong Kong, Singapore, Malta, Gibraltar, etc) or elsewhere.

If you are wondering what the report is all about, it is a very thoughtful investigation into the reasons why VCBs have so much difficulty in securing traditional banking facilities. The authors approach the issue from two main perspectives:

VCBs (4pg of the report)

Banks (7pg of the report)

“In order to operate, though, VCBs themselves rely on banks to conduct fundamental payment, savings, foreign exchange and other financial functions.”

PostRaise’s perspective falls somewhere in between the two. PostRaise has a deep interest in seeing VCBs succeed, as their potential for good in the world is immense. That being said, we are still in the early stages of the development of the Crypto/Blockchain industry, and most VCBs still require a reliable connection(s) to the Fiat world. Without this, their potential may not be fulfilled.

VCBs SECTION

From this section of the report, I wanted to highlight a couple of aspects which I found very interesting.

The first is that, although the authors broke VCBs into 6 categories (Wallets, Exchanges, payment processing, specialized service providers, Mining & Blockchain) the feedback they received from founders they spoke with suggested that banks were unable to distinguish one category from another, and all had difficulty securing banking facilities.

Amazingly, this is still the case at the time of writing (June 2019). One exception I have come across relates to Blockchain. Let’s say you are developing a Blockchain (e.g. for identity, supply chain), you received funding from a VC, no public sale of tokens has taken place, and there is no intention to do so in the foreseeable future. If you fall into this category, you will likely find it easier than most to obtain and maintain banking facilities.

“From our discussions, it was clear that lack of access to the banking system is a significant issue for many, if not most, VCBs. This lack of access can be devastating to VCBs as banking services play a variety of roles within a VCB’s operations.”

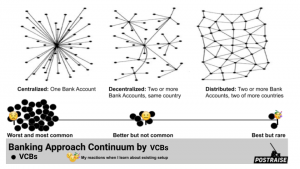

The second aspect is one which I have come across all too often when working with VCBs, and it’s the trap founders fall into all too often. They mistakenly assume the banking facility they just set up will always be available. This is, unfortunately, not the case. To make matters worse, when the banking relationship is terminated, funds can be frozen for weeks or months, leading to salaries not being paid and a lot of unnecessary stress.

“Another issue VCBs reported is that banks, after having provided a bank account, have suddenly terminated such accounts with no more warning than a letter and without providing much if any rationale or justification.”

Ideally, you want to be as far to the right of the continuum as possible..

Where are you currently?

The VCB section of the report is not all doom and gloom, in fact, some VCBs reported back of their relative success. The 4 key areas which they felt helped them were:

- “They made regulatory compliance a high priority area and have, from day one of their operations, put forth the resources necessary to obtain internal talent and external advisers familiar with regulation and compliance. One VCB reported that one-third of its staff are compliance personnel”.

- “They are associated with prominent founders, investors and/or executives and advisers with experience in finance, start-up operations, technology and regulation.”

- “They employed compliance-related software to allow their banks to monitor their activities in a highly transparent manner.”

- “Some of the VCBs observed that their services do not involve taking custody of virtual currency and that explaining the distinction helped their banking partners become comfortable banking them.”

The report does touch briefly on “Geographical Differences”. As mentioned previously, obtaining banking facilities seems to be a problem for virtually all VCBs, irrespective of the jurisdiction(s) their business is located.

“Some VCBs reported difficulty with obtaining banking relationships in the United Kingdom, but others reported some success. There have also been mixed results in the European Union with several different European banks.”

BANKING SECTION

My takeaways boil down to a few elements:

- Banks assess potential clients on a Risk-Adjusted Basis (supposedly).

- They face a ton of regulation which they use as an excuse to avoid banking VCBs.

- Banks are focusing on existing business lines and are “de-risking” others.

- Most don’t understand VCBs (see quote below).

“First, there is a widespread perception that virtual currencies are primarily used to evade the law and commit crimes. Indeed, Bitcoin was used as the means of payment on the notorious “Silk Road” online marketplace, and is used as means to pay off hackers in ransomware crimes.”

The below was really funny to me, as this “advantage” is exactly what I help my clients to obtain.

“VCBs are generally reluctant to discuss what banking institutions they maintain relationships with, as in the words of one VCB founder, “bank accounts are a competitive advantage in this industry.”

Another part that’s worth highlighting is:

“In many cases, merely mentioning that an account applicant was a VCB was enough to terminate the discussion.”

If you think the answer to getting a bank account is “pretending” not to be a VCB, save yourself the trouble! The bank will figure it out pretty quickly and when they do, you’ll have to bid goodbye to your bank account. They might feel entitled enough to hold on to your money for an indefinite period of time.

Rather, find a bank who is open to working with you in the full knowledge that you are a VCB. If you don’t know how to do that, check out the recommendations in the report (14-15pg). If you still don’t know what to do or simply want to outsource the entire process, reach out to PostRaise for help.

RECOMMENDATIONS SECTION

I pulled out two recommendations from the report. One I agree with, and one I disagree with:

Agree: It is crucial to have your documentation in good order. When working with clients, I use this information to create what I call a “business case”. This is used to have a constructive conversation with the bank about the VCB and ideally to get pre-approval before the application goes in for full assessment.

“Recordkeeping and Reporting. Banks are likely to scrutinize a VCB carefully. They will require extensive reporting and production of sensitive documents. VCBs should be prepared to share such documents with their banking partner and have systems in place to obtain records quickly for delivery to the requesting bank. Such documents and records might include governance documents, organizational charts, customer invoices, accounting records, audit records, records demonstrating compliance with AML requirements, customer transactions and identification and tax information. It will be important for VCBs to realize that a bank’s due diligence will be enhanced and ongoing after the relationship is established.”

Disagree: If you do a, b & c it should be possible to have an account up and running in 1-3 months, and not the 6-12 months mentioned below.

- Make sure you are speaking with the right bank.

- Make sure to speak with someone senior before submitting the application.

- Make sure you submit ALL of the supporting documentation when the application goes in.

“Prepare for a Lengthy Diligence Process. VCBs should prepare well in advance of applying for a bank account. The process from approaching a bank, submitting materials, interviewing with the bank and finally obtaining a bank account may take between six to twelve months. Start-up firms looking to establish accounts should thus establish a bank account as an early activity. Mature firms expanding product offerings should seek to obtain broader banking services or secondary and tertiary accounts early in their expansion efforts.”

REPORT CONCLUSION

“Despite the significant and continuing capital inflows into VCBs, and recently blockchain-oriented initiatives in particular, VCBs continue to struggle to gain and maintain access to the banking system. While no one party—the VCB industry, banking sector or banking regulators—is to blame, each have a role to play is resolving this issue. Significant work is left to be done in the areas of public policy advocacy before the financial regulators and compliance enhancements by VCBs. This paper presents various recommendations that we believe will help increase VCBs’ access to banking services in a way that is fully consistent with regulatory expectations that banks operate in a safe and sound manner fully compliance with their legal and compliance obligations.”

POSTRAISE CONCLUSION

PostRaise’s conclusion with the benefit of working at the intersection between VCBs & Banks in 2019 is as follows:

While the degree of difficulty obtaining and maintaining Fiat banking facilities has not really changed in the 3 years, there are banks who are forward thinking in many countries. It’s your job as a founder of a VCB whose viability hinges on having banking facilities to do the work necessary to find them.

To be clear, one banking relationship will not cut it. There is an old saying “two is one and one is none” so once you have found the first bank, get back up on that horse and find the next one!

Depending on how critical a connection to the Fiat world is to your business, this will determine how many accounts you should have.

I recently reached out to a founder of a very well known VCB (their valuation is easily north of 1 billion) and he told me “We actually maintain about two dozen accounts, including half a dozen transactional ones, across banks around the world”.

Now I’m not suggesting your VCB needs to have 10+ accounts, but ask yourself (especially if you have one or two bank accounts):

What would my business look like if my bank account wasn’t there tomorrow or at the end of the month when you need to pay your team, rent etc?

If you don’t like the answer, then it’s time to fortify your banking!!

If you don’t have the time, contacts or willingness to do this yourself, find someone who can help. Of all the possible reasons for your business to fail, don’t let a manageable variable like banking be your downfall.

Or to put it another way, don’t be an ostrich. Get your head out of the sand.

Final thought: If the last three years has taught us anything, it would be don’t expect it to become easier for VCBs to open/maintain banking facilities in the next three years. PostRaise is here to help should you need it.

Acknowledgements:

- All the credit in the world for this article goes to Pratin, David & Andrew from Arnold & Porter LLP and Coin Center for creating this excellent report. If you are a Crypto business with even the slightest tangential connection to the Fiat world I would highly recommend reading it cover to cover!

- I have quoted parts of the report in the article. When you see something like this: “it is a section copied directly from the report and all credit goes to the authors”.

- I have referred to Crypto businesses as VCBs as this is what the authors use in the report.