I don’t think we will ever be in a more perfect position to take this bull by the horns. In an age of negative interest rates offered by some of the world’s biggest economies and rising inflation and political risks amongst the smallest, the hunt for yield is on.

What is DeFi?

Decentralized Finance or DeFi is the latest buzzword to hit the crypto community bringing with it an ecosystem of semi-familiar financial products and services – reskinned for the crypto age. Imagine having the ability to borrow, lend and invest, both anonymously and instantaneously, no waiting in line or 3 months bank statements needed. Well now you can, all from the comfort of your couch and with something as simple as your cellphone – congratulations, you are now your own bank!

“Going bankless is a journey towards financial freedom, self-sovereignty and financial independence” – Ryan Sean Adams: Bankless Substack

How Big is DeFi?

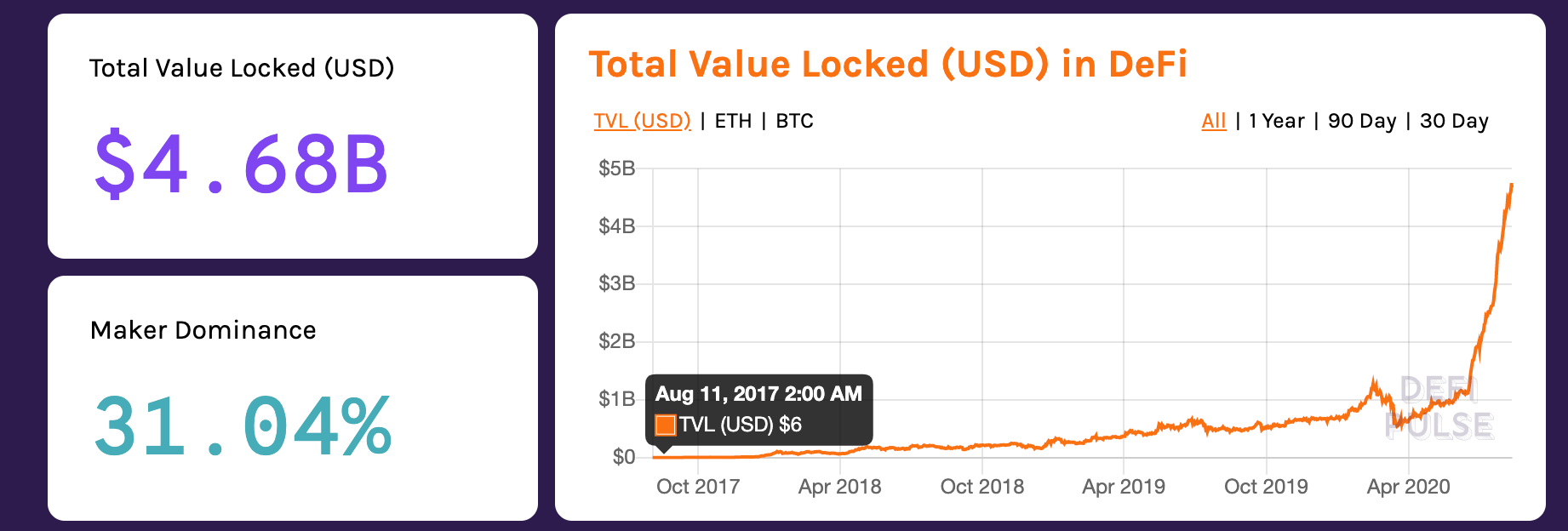

To put into perspective how many people have embarked on this journey you can always turn to our good friends over at Defi Pulse, a blog dedicated to the numbers behind DeFi and its associated moving parts. Since this day two years ago, TVL, or total value locked in the DeFi network has increased from a laughable $5 to just shy of $5 000 000 000 today. It is highly evident that this is an ecosystem here to stay, ruffle the feathers of traditional banking systems and draw huge amounts of market capitalization under its wing.

The second set of metrics that play an important role in assessing the ecosystem are social metrics. The Cryptoverse is largely driven by the cult like community behind it, both in terms of price and adoption.

I was fortunate enough to take part in the Global DeFi Summit last week where Lunar Crush, a cryptocurrency analytics platform that tracks mentions of coins and engagements on posts across social media, had some pretty parabolic numbers to share around DeFi focused projects. Aave ($LEND), a lending protocol has seen a 576% increase in social engagement over the past 3 months, Bancor ($BNT), a cryptocurrency exchanging protocol has seen a 424% surge in news volume surrounding the project and Chainlink ($LINK), a real world data provider has amassed a total of 3500 new owners over the last 24 hours.

How do You Participate and Make Money with DeFi?

Now, there are various ways to begin drawing value out of the DeFi system, all of which I will be covering through this DeFi series but the message I am trying to convey today is an important one – The bus is moving and you don’t want to be left behind.

Stay tuned for Friday’s post where I will begin breaking down the nitty gritty of DeFi, how you can get involved and where the value lies waiting for you.