Press Release: Tuesday, June 1 2021, 14:00 CAT | Source: Revix

A diverse investment portfolio that includes a combination of traditional and alternative asset classes is the best way to future-proof your investment, particularly during economic slumps, writes Sean Sanders, founder and CEO of investment platform Revix.

Like the age-old adage about the eggs and the basket, it’s unwise to put all your savings into a single investment, asset class or geography, as this can significantly increase your risk of loss. Think of the 2008 housing crisis in the United States, Enron, Lehman Brothers, Steinhoff – or even Venezuela and Zimbabwe as case studies. While it is inevitable that investing can be risky, this risk can be managed by diversifying your investment portfolio.

Diversification explained

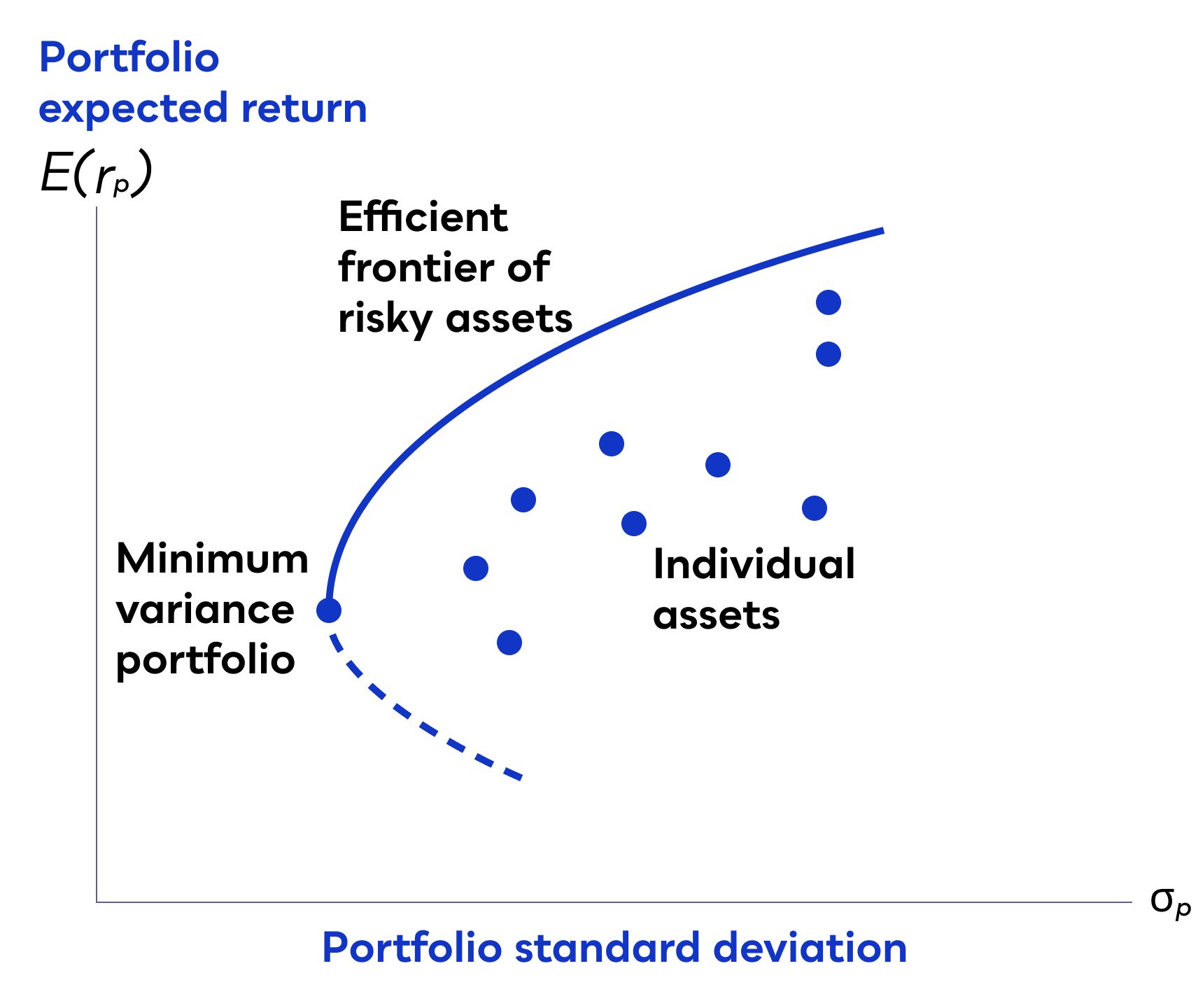

Diversification is a risk management technique that includes a variety of different investments within a portfolio. Simply put, some assets can make up for losses in one area with gains elsewhere. The rationale is that a portfolio of different kinds of investments will yield higher risk-adjusted returns over the long-term than any single investment within the portfolio.

Correlation is the X-factor

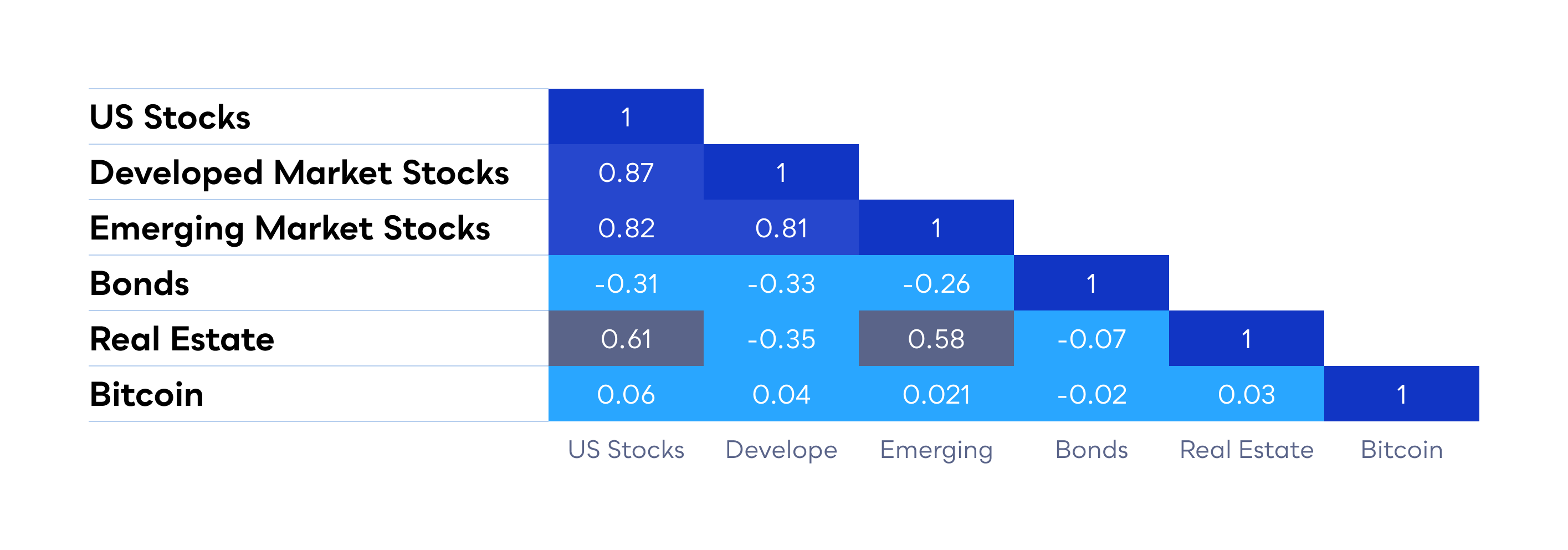

Your asset allocation is one of the most important investment decisions you’ll make. Diversification can only occur if investments within a portfolio do not perfectly track one another – this is known as correlation. Thus, correlation coefficients are used as a numerical relationship measure. A correlation of +1 would represent a perfect correlation. This means, there is a perfect positive relationship. A correlation coefficient of -1 would represent a perfect negative relationship. While a correlation coefficient of 0 represents a very weak relationship.

The trick is to find a number of investments with low or negative correlations to one another. These low correlations represent different performance drivers. Low correlations are easy to find in alternative assets with very different structures to stocks and bonds.

How cryptocurrencies can diversify your portfolio

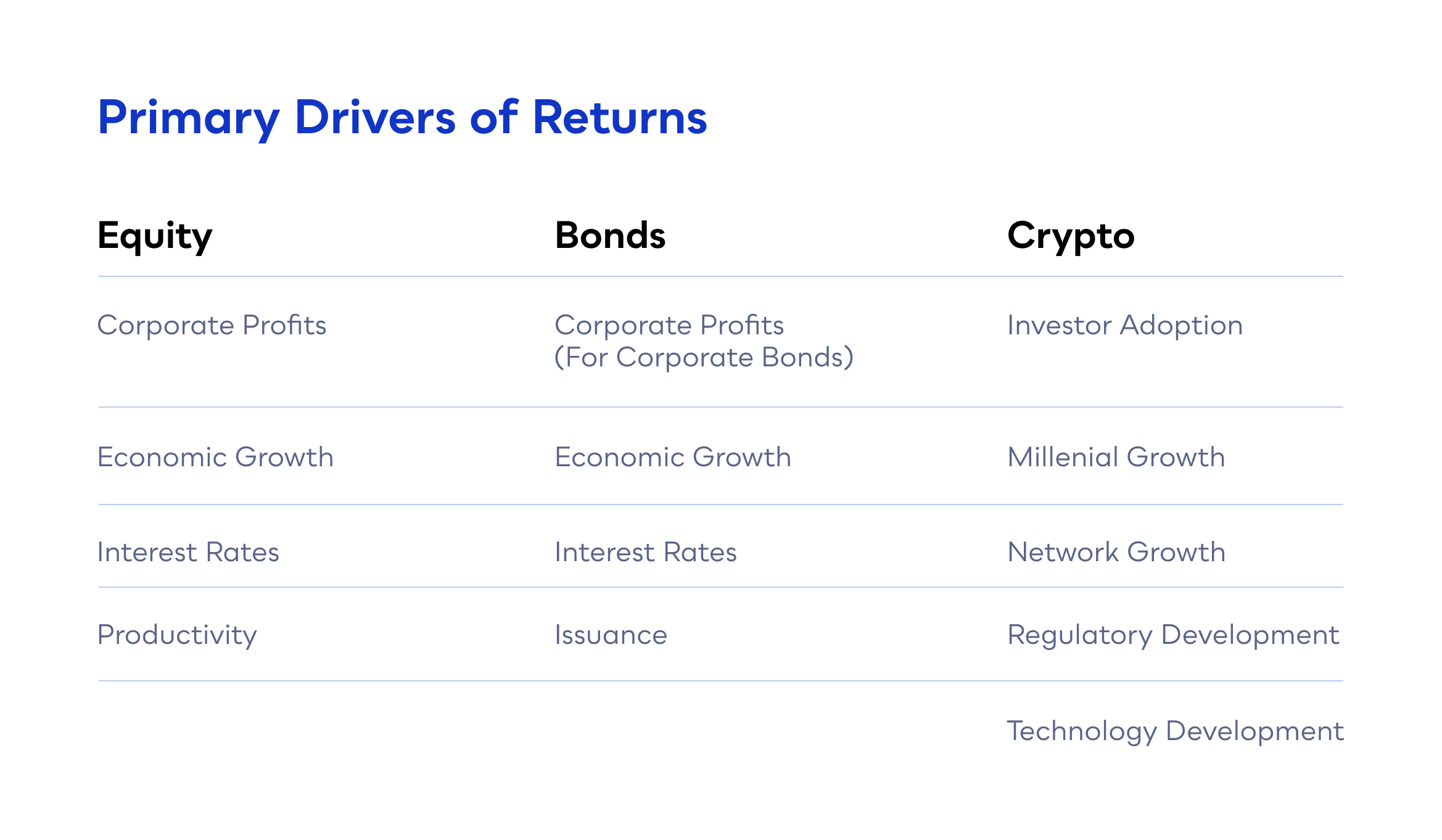

Cryptocurrencies’ ultra-low correlation to all other asset classes makes it a useful diversification solution. As seen in the table below, ‘Alternatives’ have a very low correlation to traditional assets like equities and bonds. The question remains as to whether these low correlations will persist. There is very good reason to believe that they will, as the primary long-term drivers of returns are fundamentally different to that of traditional commodities.

The Decrypting Cryptocurrencies Report published by JPMorgan in 2018 analysed correlations from the perspective of overall portfolio diversification. The report considered cryptocurrencies as it would any other asset class and evaluated how crypto assets would impact a portfolio’s risk-return characteristics.

The report found that while crypto volatility is significantly higher than equities or commodities, they simultaneously enhance returns without significantly increasing overall risk, due to the fact that cryptocurrencies are driven by low correlation to every other asset class. Simply put, portfolio efficiency could be improved with the addition of cryptocurrencies.

Alternatives come with their own set of risks. They should not entirely replace traditional investments that are somewhat more predictable and less volatile. However, cryptocurrencies should form part of a balanced, well-diversified portfolio. The size of the allocation depends on the investor’s investment goals and risk tolerance.

Bundles allow diversification within the cryptocurrency market

Crypto bundles offer a growth-minded approach to investments in cryptocurrencies.

These diversified pre-selected bundles are made up of the top-performing cryptocurrencies and allow investors to invest directly in the underlying cryptocurrencies within a particular bundle. This is the easiest and most financially sound way to investing in this emerging investment class – especially for first-time investors. A Top 10 bundle from Revix, for example, allows investors to invest in a bundle of the top 10 performing cryptocurrencies, which is adjusted on an ongoing basis.

The global pandemic was cryptocurrencies’ litmus test

The global pandemic has been a litmus test for how crypto assets act under market pressure. Mass panic saw the stock market fall dramatically and resulted in a liquidity crisis long before the effects of an economic crisis were felt. While the cryptocurrency market also collapsed temporarily, it bounced back fairly quickly to reach its highest point historically. It has also shown resilience by outperforming other traditional assets.

Additionally, cryptocurrencies are a potential hedge against mass fiat currency devaluation in much the same way as gold during economic recessions. If inflation and global debt continue to skyrocket, global fiat reserve currencies will continue to lose significant value, which may make cryptocurrencies a more viable alternative store of value. The fact that a nation as sceptical as China named cryptocurrencies the number one asset class of 2020 has also bolstered global interest in this alternative asset class.

What’s next?

Looking into the future, one thing we can be certain of is emotion. All markets get overhyped and overpriced at various times as investors’ emotions filter through to asset prices. However, these ups and the downs do not mean that cryptocurrencies, or any other asset class, should be dismissed as overly risky or having unsustainable investment returns.

Globalisation and the rise of alternative investment solutions have transformed the investing game, even in developing markets such as South Africa. Cryptocurrencies have helped emerging market investors transcend barriers and offered access to a liquid and uncorrelated asset class beyond their home markets. These alternative asset classes have opened the door for an inclusive global investment community where creating a diversified portfolio is easier than ever before. And with Security Token Offerings (STOs) not too far off in the future, there’s still much more inclusive opportunity to come.

— – – – – – – – – – – – – – – – – – –

This article is a Press Release received from Revix. Global Crypto did not receive any form of compensation for its publication, and as this material is deemed newsworthy for the Southern African blockchain industry, it was thus published accordingly.