This article is a ‘partner post’ published in association with PrimeXBT

While most of the mainstream attention around the recently booming cryptocurrency market has been aimed at Bitcoin and its push towards the previous all time high of $20,000, it is Ripple’s XRP that has actually been shining brightest.

The price of XRP managed to more than double in the previous week as it topped $0.74 with many speculating that the coin might break the all important barrier of $1. Additionally, the trading volume of XRP also skyrocketed with this price boom.

It would have been easy to put this price rise down to the booming cryptocurrency market but analysts have put together a few catalysts that may be behind it with a utility fork of the XRP token, called spark, getting an airdrop being one key point.

However, while this fork and airdrop, which would allow XRP holders to be entitled to an equivalent amount of Spark — and thus incentivise buying up XRP — there seems to be more to it. In general, Spark looks like it will also be good for Ripple and the XRP community, but the market will certainly have other factors driving such a price rally.

PrimeXBT’s lead analyst Kim Chua has looked a little deeper into the market movement of XRP recently and spotted a few reasons why it is not just Spark that deserves all the credit for the rally. From job adverts for Ripple and shills around XRP as well as a few key rumours going around, there is clearly a lot of action for XRP still to come.

XRP Doubles And More

After a previous report on XRP, the price of the token exploded, gaining more than 100% in a week, on record volumes that crippled even one of the largest exchanges, Coinbase. The surge in XRP volume overtook BTC and at one point was so large that it crashed the Coinbase server.

Real trading volume of XRP has exceeded that of BTC and ETH to $6 billion a day currently.

The sudden and intense speed of XRP’s rise has led many to search for answers, and people have started to uncover an airdrop that is scheduled to take place on 12 December and claim that this airdrop is the reason for XRP’s price increase.

What Is The Airdrop

This airdrop is a utility fork of the XRP token, called the Spark token, that is the native token for a new public blockchain called Flare Network. Flare Network uses a new way of scaling smart contract platforms that does not rely on the commonly used PoS consensus mechanism. The objective of Flare Network is to allow the complete trustless exchange of value between 2 entities without the need to trust a central entity.

According to Flare Network, 75% of current smart contracts still require trusting a central entity. Holders of XRP will be entitled to the Spark token on a 1:1 ratio. As the circulating supply of XRP is around 45 billion, 45 billion out of a total of 100 billion Sparks will be airdropped to XRP holders. The balance 55 billion Sparks will go to Flare Networks Limited and Flare Foundation. To determine how many Sparks one will get, a snapshot of the number of XRP one holds will be done on 12 December.

How Will This Be Good For The XRP Community?

Once Flare Network launches, its first priority is XRP. A protocol to safely enable the trustless issuance, usage and redemption of XRP will be offered to Spark token holders. For non-Spark token holders, they will be able to purchase Spark tokens using XRP tokens after the platform launches following a ratio determined by the Flare Oracle.

The airdrop of Spark token to XRP holders can then encourage them to use the protocol. How this works is, holders can deposit their Spark tokens onto the Flare Network, which then trustlessly mints FXRP on Flare Network, which is more or less similar to the actual XRP token and has the same value, except that it is interoperable with the ETH and other blockchains that utilise the Ethereum Virtual Machine (EVM).

This allows holders of XRP the ability to use Sparks as the tool to convert XRP into FXRP to do yield farming or for other decentralised applications, which XRP in its native state, is unable to do. Hence, this is a very attractive gift to XRP fans. However, I do not think that this airdrop can cause such a massive rally in the price of XRP since the price of the Sparks token is expected to be low since there is a required collateral ratio that Sparks needs to meet in order to mint FXRP.

The value of the Sparks token deposited as collateral has to be at least 2.5 times the value of FXRP minted, which mirrors the price of the XRP token.

“With the platform yet to launch, and most investors unsure of the impact of this platform, it will be strange that the worst performing cryptocurrency of 2017, 2018 and 2019 be pumping 150% because of its airdrop. While I agree that the Spark airdrop is one of the reasons why XRP is pumping, I do not think it is the main reason,” Chua explained.

What Else Could It Be, If Not Spark?

Firstly, there have been many airdrops in the past years which did not translate into price rallies for the associated token. One example is the recent BCH hard fork to BCH-ABC which did nothing to its price.

Secondly, when the Sparks airdrop was announced at the end of August, XRP price did not react either, the price of XRP did not rise until last weekend.

Thirdly, based on past track records of highly popular airdrops, investors did not acquire the associated token until very near to the airdrop date. The snapshot of the airdrop is scheduled to be on 12 December, which was more than 3 weeks away from the date which XRP started skyrocketing.

The rise in XRP’s price was too early for the airdrop to be the cause of it, explained Chua. Another metric that supports the fact that it may not be the Spark airdrop causing the rise in XRP price is that during the past week, most XRP trades were done on Coinbase and Huobi, which have yet to agree on supporting the Sparks airdrop.

Exchanges that have announced support for the airdrop like Bitstamp, are not getting the volume surge as much as the other 2 exchanges are witnessing.

“Granted, traders can still transfer their XRP to supported exchanges in the final moments, I however found this metric to be rather perplexing if the airdrop is the cause,” the PrimeXBT analyst said.

Ripple Seeking Central Banking Director

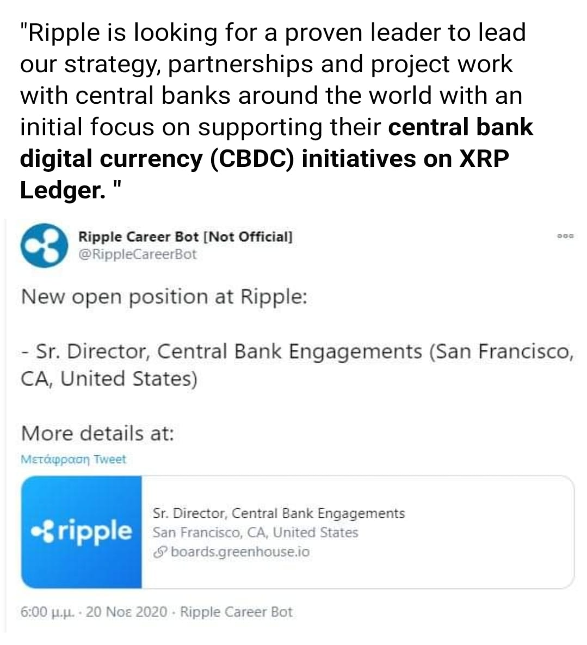

From my observation, the excitement seems to have started after Ripple put up a job advertisement on its social media site and various career sites to hire a Senior Director to lead their partnerships and project work with Central Banks in supporting their Central Bank Digital Currencies (CBDC) on 20 November.

XRP Job Ad on Glassdoor:

Ripple’s job advertisement started gaining attention as XRP fans took to social media to talk about it and the news spread far and wide. I would think this is a more likely reason since the timing of the job advertisement corresponded with the timing of the XRP price explosion.

Many were speculating that XRP could become the most important cryptocurrency since it is planning to work with Central Banks and the rumour mill started conjuring more and more theories, leading to more interested buyers to come into the fray, creating a FOMO effect.

The explosion in social and mainstream media attention gained momentum as XRP charted out a massive rally, taking out several resistances level along the way, making it the fastest rising cryptocurrency this month. The sheer magnitude of it cannot be due to a mere airdrop.

As seen from the above metric, new XRP wallet addresses have been increasing at record speed, rising 800% from the usual 1000 a day to 8000 a day. With the recent attention BTC has been getting due to it trading near its ATH, the impressive run in XRP has fed on itself to bring in even more new participants, in hopes for XRP to also rise to its ATH of $3.30.

Rumour Mill And Shilling Running Rampant For XRP

There are currently many Youtube Gurus and TikTok Gurus shilling XRP to the moon, with one even calling XRP to go to $440. While some targets are quite far away, the reasons why aren’t that far-fetched. Fans think the token will continue to rise because the project is bank-friendly and it claims to be working with over 350 financial institutions.

These financial institutions have been buying XRP for usage in remittances for its high speed and low cost. Hence, Ripple unravelling its next stage of institutional adoption by way of supporting CBDC is indeed a very compelling proposition for XRP, especially since CBDCs are expected to be launched as soon as early next year.

We do not know as yet if Central Banks will need to purchase XRP to issue their CBDC or if Ripple Labs will be successful in engaging Central Banks, however, given the scale of the potential, the rise in price seems warranted, at least to me, as Ripple has had a rather fruitful record in its attempts at working with banks.

Given the amount of social media shills and the high media visibility of its founder Brad Garlinghouse, I expect this run up in XRP price to be sustainable, albeit filled with high volatility. We are already witnessing big rises and falls in XRP price even before the airdrop date of 12 December, which is still some time away. If investors are buying XRP because of the Sparks airdrop, shouldn’t the price of XRP retrace only until after 12 December? However, we are seeing large retracements happening along the way as we speak.

No Instant Gratification For Spark as Distribution Will Be A Long Time Frame

The way in which Spark token is distributed also does not support a case for chasing XRP for “free money”, because the airdrop is staggered to be released over a period of time, reducing the number of scalpers who merely want to get free tokens to cash in.

The number of Spark tokens to be distributed to XRP holders is on a 1:1 ratio. However, at network launch, each XRP account will only receive 15% of the total Spark token for which they are eligible*. The remaining Spark claimable will be distributed over a minimum of 25 months and a maximum of 34 months, this does not sound very attractive for short term traders. A smart trader may simply wait to buy Sparks using his XRP later after the platform launches, instead of chasing the price of XRP up several times for the airdrop.

XRP’s Positive Events All Coming To Roost At Once

While the Spark airdrop could be a big factor for XRP’s recent intoxicating run, there are other reasons behind its current trajectory.

“Other than what I mentioned above about the news of potential CBDC partnerships, other reasons like its increased adoption by institutions, and the recently announced buy-back by Ripple Labs are also contributing factors. In my humble opinion, this rise is the result of the cumulation of many positive developments coming to fruition and the market reacting to them, not merely traders greedy for an airdrop,” said Chua.

“As such, I do not think that XRP price will drop drastically after the snapshot date on 12 December. It may drop even before, as traders who did not understand the airdrop and started chasing the price of XRP start selling XRP after he gains clarity about it. Hence, I expect big up and down swings in the price of XRP to continue until after the airdrop,” She concluded.

Following the snapshot, Chua does expect the price of XRP to correct as some traders may sell after the event in the hope of buying back at a lower level, but she does not expect the price to crash since there may be long term investors who are waiting to buy on dips.

The play on XRP may not be over since Ripple may have many partnerships in the pipeline and is actively creating more use cases for its XRP token. With such a hardworking and focused team, there is a high chance that more positive news may be forthcoming.

Hence, while the airdrop is very enticing, Chua does not think that traders are buying XRP solely because of it. What she thinks is that whatever Ripple has been doing for XRP is gaining the recognition and attention it deserves. On the back of an ongoing bull market which XRP has underperformed greatly until recently, XRP is merely playing catch up with the rest of the crypto market.

*Ripple Labs and former Ripple employees will not be eligible for the Spark airdrop. XRP held at exchanges that do not support the Spark airdrop will also not be eligible for the airdrop.

All analyses are provided by lead PrimeXBT market analyst Kim Chua. Traders can long or short XRP as well as a number of other popular cryptocurrencies with the award-winning PrimeXBT, not to mention offerings of margin trading, forex, gold, silver, oil and commodities, as well as stock indices, and more.