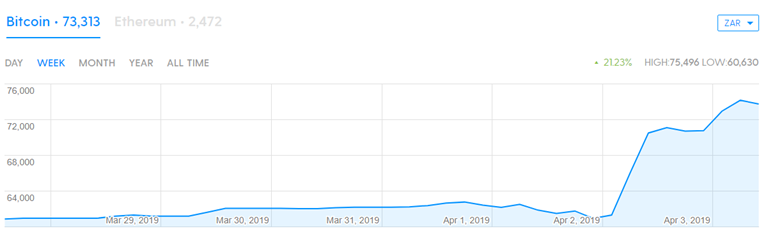

The price of Bitcoin, the world’s largest cryptocurrency by market capitalisation spiked 21% over the last week on the Luno exchange. There is much speculation as to what is driving the price back to the same level, last reached in November 2018.

There have been a number of bullish signals in the market over the last month, including large banks and tech companies moving into the sector, positive news on Bitcoin’s scaling capacity, and a host of new instruments like stablecoins with much better defined use cases, much of which one needs to access via existing crypto onramps.

We picked up some of this interest through high engagement rates on the Luno platform, where people constantly checking the price were not yet buying. There has been much pent-up interest and capital, from both consumers and institutional investors, who want to make sure they don’t miss the next wave as the asset class appreciates in line with its long-term upward trend.

As soon as the recent period of relative price stability was broken, it was bound to attract buyers and sellers to the market. This spike appears to be caused by a large buyer or group of buyers that finally entered the market and set off a broader buy trigger.

However, at the moment any buying of Bitcoin tends to lead to a period of speculation. This is the ongoing theme for the currency, so we expect more volatility to follow, as we have seen with tens of similar waves over the past years, but always ending up in a stronger position over time.

At Luno, we do not take a position on the price of Bitcoin. We simply aim to be the easiest platform to buy, sell, and learn about, cryptocurrencies. Since Luno launched in 2013, we’ve seen many price spikes and we’ve seen many drops. Much of our resources are spent on educating the market, we’ve built a dedicated learning portal where we explain the dynamics of markets that are very volatile and can move up or down in a short amount of time. This price hike is a good example.

We therefore encourage responsible investing, which includes never investing in something you don’t understand, and never spending more on speculative technologies like Bitcoin than you can afford to lose.

Many declare Bitcoin dead (or dying), simply based on the latest changes in the price. In fact, according to this website, it’s died 349 times! Bitcoin should become less volatile as there is increased liquidity and market acceptance, and Bitcoin will continue to play a dominant role in the cryptocurrency industry.

Interestingly, activity on the Luno platform has not diminished since the crypto price pull-back a few months ago. We find ongoing interest from new users.