MARKET UPDATE:

- DeFi put under pressure: Flash loan attacks

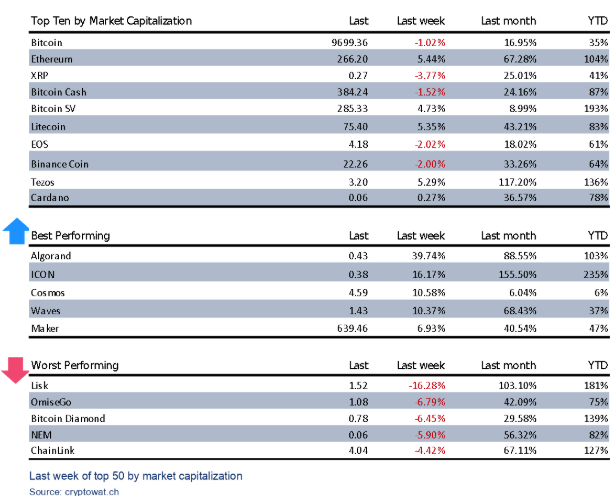

- First red week in a month for most cryptos:

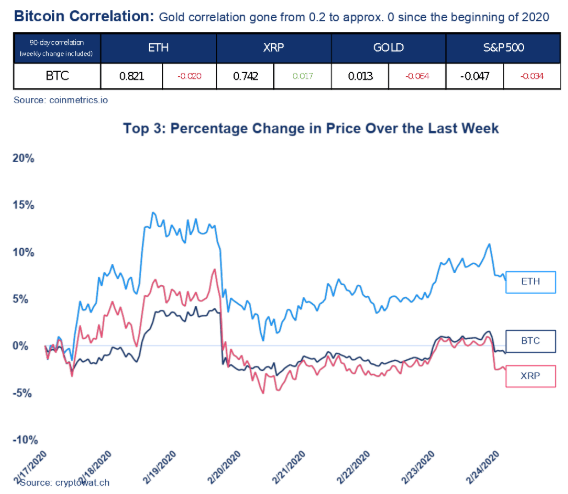

ETH outperforms BTC - Fifth largest hourly price drop in bitcoin’s history

- Bitcoin volume keeps rising – new yearly highs

- Growing institutional demand?

– CME trading volume crosses $1 billion

– Bakkt delivery stays high

– Bakkt open interest with new all-time high

VALUATION:

- Bullish signal for Bitcoin price

- Golden cross: 50DMA crosses over 200DMA

- Retail stays more bullish than institutions

BLOCKCHAIN ACTIVITY:

- More market participants returning to the Bitcoin network?

– Active addresses up to peak 2019 levels

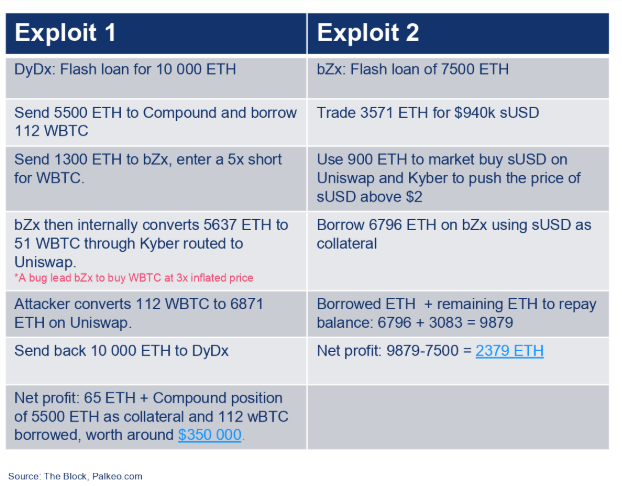

DEFI PUT UNDER PRESSURE: FLASH LOAN ATTACKS ON BZX

- The last week saw two attacks on bZx, a decentralized margin-trading platform.

- The attacks utilized bZx’s flash loan, a product that allows traders to make uncollateralized loans that are repaid in the same transaction as it’s taken out.

- The attackers exploited buggy code and poor liquidity in DEXs in order to manipulate various ETH-pairs, creating massive profits and leaving bZx with uncovered loans.

- bZx shut down Fulcrum, its lending platform using its administrator key and locked down the endangered funds.

These attacks highlighted two important aspects of DeFi:

- In DeFi applications, the code will always be the law. Buggy code and limited price feeds based on illiquid decentralized exchanges is a challenge that needs to be solved in order for DeFi to prosper.

- DeFi applications is centralized to some extent. Utilizing an admin key the developers of the applications may intervene and freeze contracts.

FIRST RED WEEK IN A MONTH FOR MOST CRYPTOS: ETH OUTPERFORMS BTC

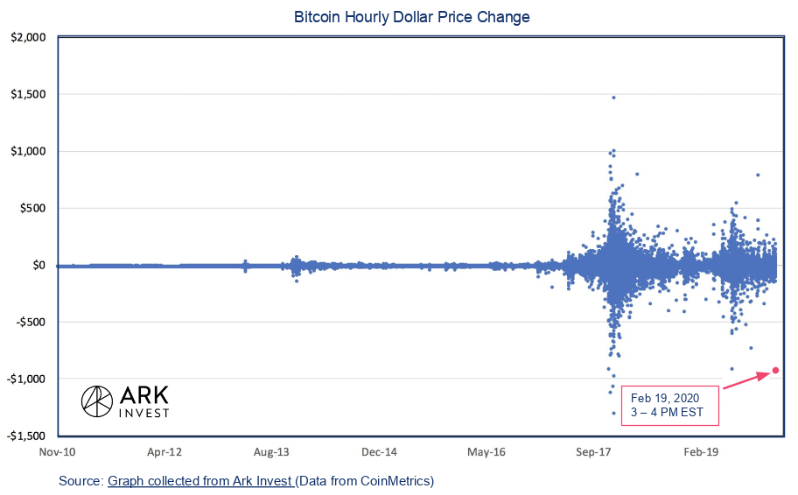

FIFTH LARGEST HOURLY PRICE DROP IN BITCOIN’S HISTORY

- The pullback we saw in the bitcoin price on Wednesday went into the history books, according to Ark Invest.

- This was the fifth largest hourly price drop in bitcoin’s history, measured in dollar.

- The only time we have seen larger dollar price drops was during the peak in December 2017.

- Although this is an interesting observation, a measure of % price change is much more useful and paints a different picture:

- Measured in percentage price change, this drop of 9.1% ranks 122nd in bitcoin’s history.

- Still, this price drop is the largest hourly percentage drop since the peak in 2017.

ALTCOINS WITH LARGE PULLBACK – STILL AHEAD OF BITCOIN

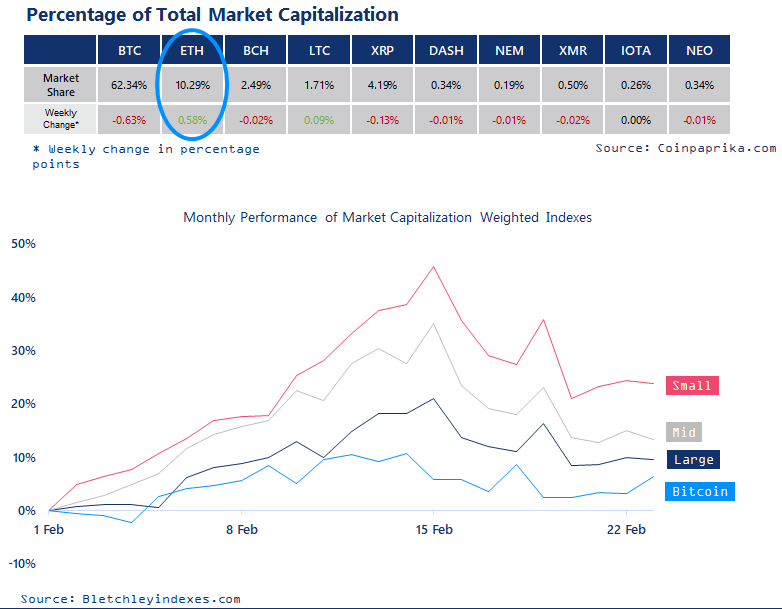

We have seen a large pullback for most coins over the last week. Bitcoin is holding its small gains best, but most altcoins are still far ahead in February.

- Small Caps has lost half of its gains for February, now down to “only” 24% return this month.

- Altcoins are still outperforming bitcoin, as the leading cryptocurrency has gained merely 6% so far in February.

ETH continues to add to its total market share this week. ETH has gone from 7% market share to over 10% so far in 2020. That equals around $14 billion added to its total market capitalization.

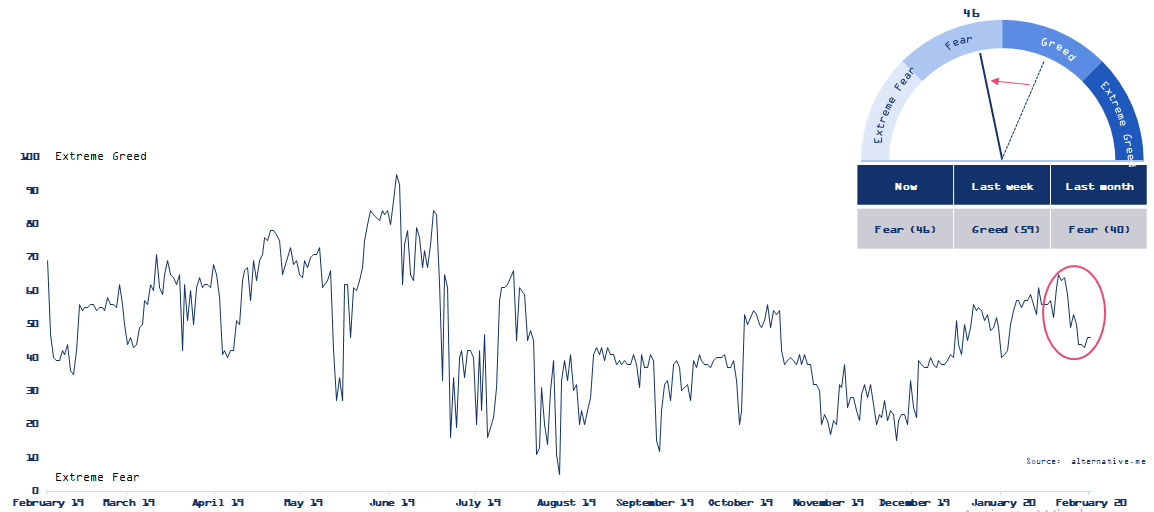

THE FEAR IS BACK IN THE MARKET – JUST A HEALTHY PULLBACK?

The Fear & Greed Index has been falling lately and is now down to 46 after the sharp pullback. As it looked like we were going to ‘Extreme Greed’, the sentiment turned and is now at ‘Fear’ levels again. We saw a similar pullback just a couple of weeks ago, when the BTC price dropped from approx. $9,000 to $8,200. That just ended up as a small pullback before the price continued upwards.

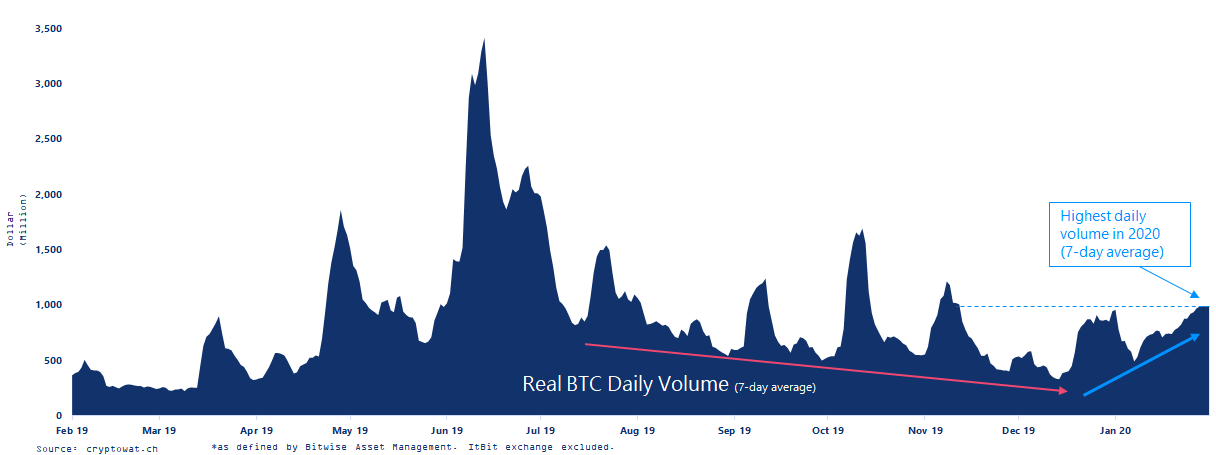

BITCOIN VOLUMES KEEP RISING – HIGHEST VOLUME IN 2020

The 7-day average real trading volume* continued up last week, as we’re approaching a daily volume of $1 billion. We have undoubtedly seen a trend shift in volume since the beginning of the year. It is certainly a healthy signal when the trading volume follows the price rise.

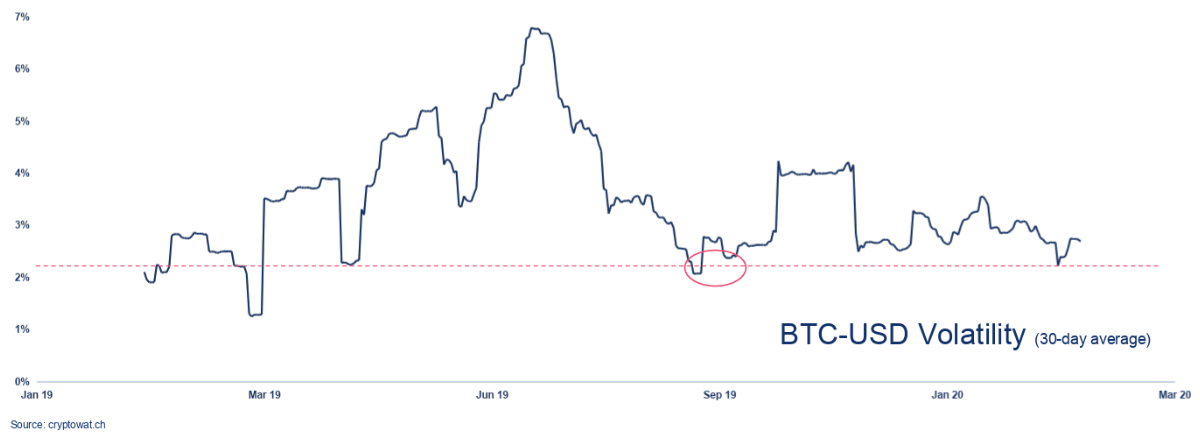

VOLATILITY REBOUNDS AFTER BTC PRICE DROP

On Feb 14, the 30-day volatility touched levels we haven’t seen since September last year. However, volatility recovered sharply and is now back in the range we have seen over the past months. This was largely due to the price drop on Feb 19, when the price went down over $1,000.

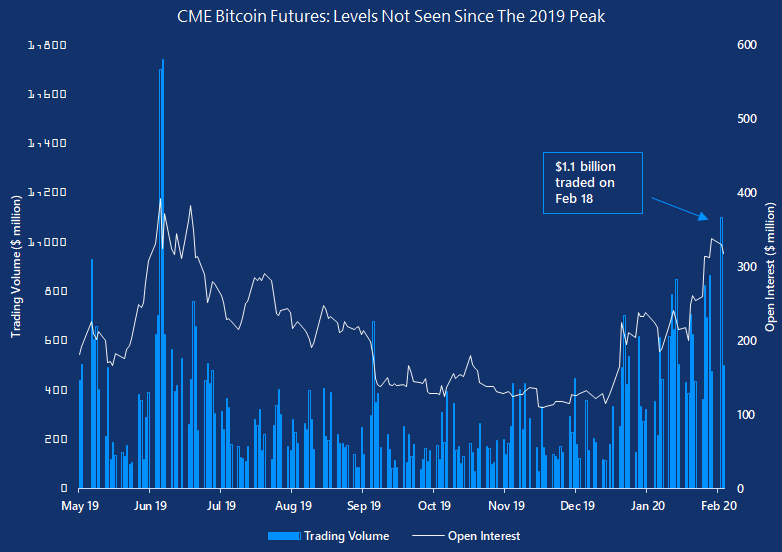

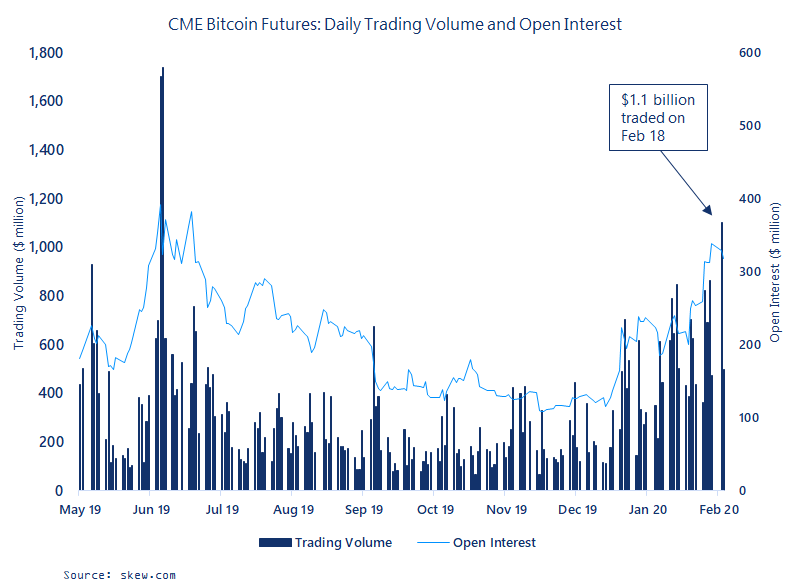

CME TRADING VOLUME CROSSES $1 BILLION – HIGHEST SINCE 2019 PEAK

- The institutional demand for bitcoin keeps growing.

- Just two weeks ago, we reported in the growing CME trading volume. The volume has continued up, and just passed $1 billion for the first time since the peak in mid-2019.

- The open interest is also at the highest level since last summer, touching $338 million last week.

- Compared to the leading futures exchange, BitMEX, CME is much closer to its previous volume highs. BitMEX saw over $14 billion in daily volume during the peak in 2019, but the volume is now closer to $4 billion.

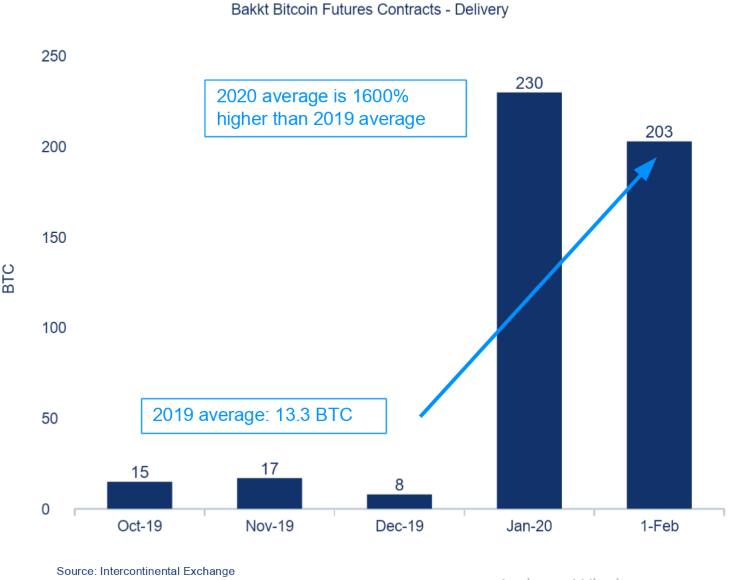

INCREASING INSTITUTIONAL DEMAND? DELIVERY OF BITCOIN ON BAKKT STAYS UP IN FEBRUARY

It is not only on CME that the institutional demand is increasing. Similar to what we saw last month, the amount of contracts held to expiry on Bakkt in February were much higher than the 2019 average.

- 203 Bakkt BTC futures contracts went to delivery on Feb 24, representing just below $2 million in notional value.

- This is a significant increase from what was seen in 2019, but a bit lower than last month.

- As mentioned a month ago, this increase in 2020 of physical delivery could indicate growing demand for holding bitcoin among institutional investors

- ED&F Man Capital Markets is still accounting for a significant part of the delivered bitcoin, which both Digital Galaxy and XBTO have used earlier for clearing. As Digital Galaxy launched two bitcoin funds late last year, this may be the source to this significant increase.

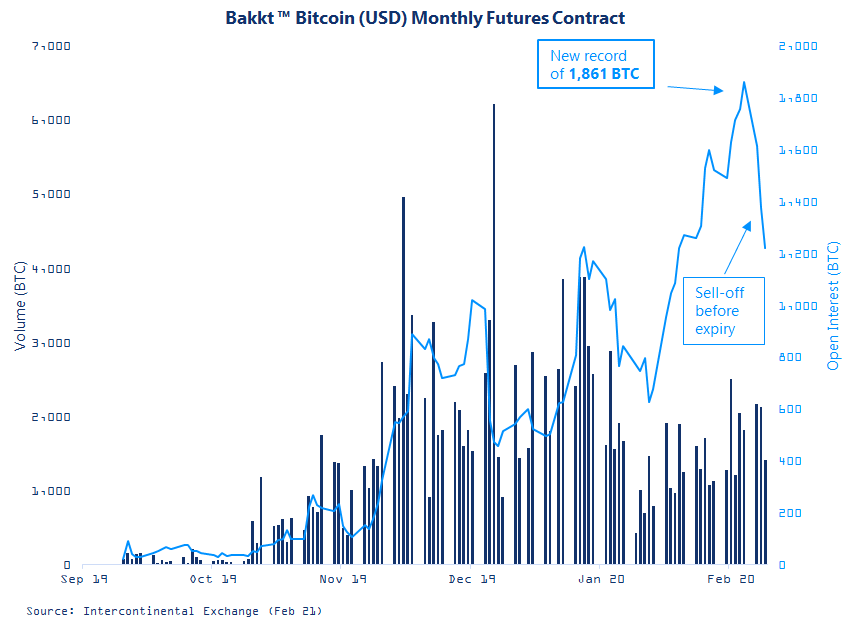

INSTITUTIONAL TRADERS FLOWING INTO BITCOIN

OPEN INTEREST ON BAKKT UP 270% IN 2020

- More institutions are betting on bitcoin in 2020, with the open interest on Bakkt growing exponentially over the last month.

- After a dip about a month ago, the number of open contracts have been pushing to new highs – topping out at 1,861 BTC on Feb 14.

- This is an increase of 270% since the beginning of the year.

- Naturally, the open interest dropped again last week with the expiry of February contracts on Feb 24 – a common observations in futures market with physical delivery.

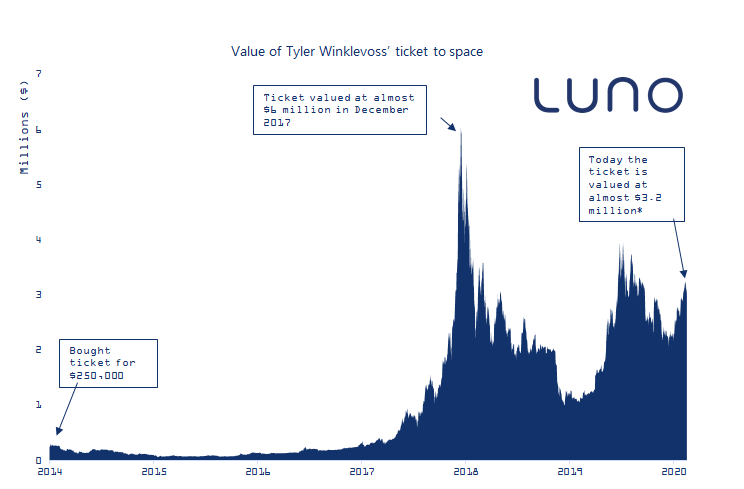

WORLD’S MOST EXPENSIVE TICKET TO SPACE?

In January 2014, Tyler Winklevoss bought a ticket to Virgin Galactic’s passenger carrying spaceship for $250,000.

In January 2014, Tyler Winklevoss bought a ticket to Virgin Galactic’s passenger carrying spaceship for $250,000.

- This ticket was bought with bitcoin when the price was around $800, equaling a ticket price of roughly 312.5 BTC.

- In other words, Tyler Winklevoss bought a ticket to space that is currently valued at approx. $3.2 million*. That is an increase of 1174%

- Tyler has later described this as his “Bitcoin Pizza moment”, comparing the purchase to the 10,000 BTC pizza purchase in 2010.

BULLISH SIGNAL: GOLDEN CROSS FOR THE BITCOIN PRICE

- The bitcoin price turned to the downside last week, finding support around the POC close to $9,300 as mentioned last week.

- More importantly, we got a ‘golden cross’ for the bitcoin price last week. This happens when the 50-day moving average crosses over the 200-day moving average.

- This is a bullish indicator and is a strong confirmation of a change in trend.

- The last time this happened was April 23rd, 2019 at $5,400. Back then, the price had a similar pullback as we have seen recently, before continuing upwards over 50% the following month.

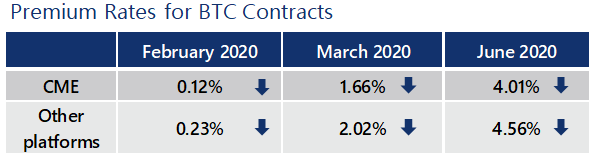

RETAIL STAYS MORE BULLISH THAN INSTITUTIONS

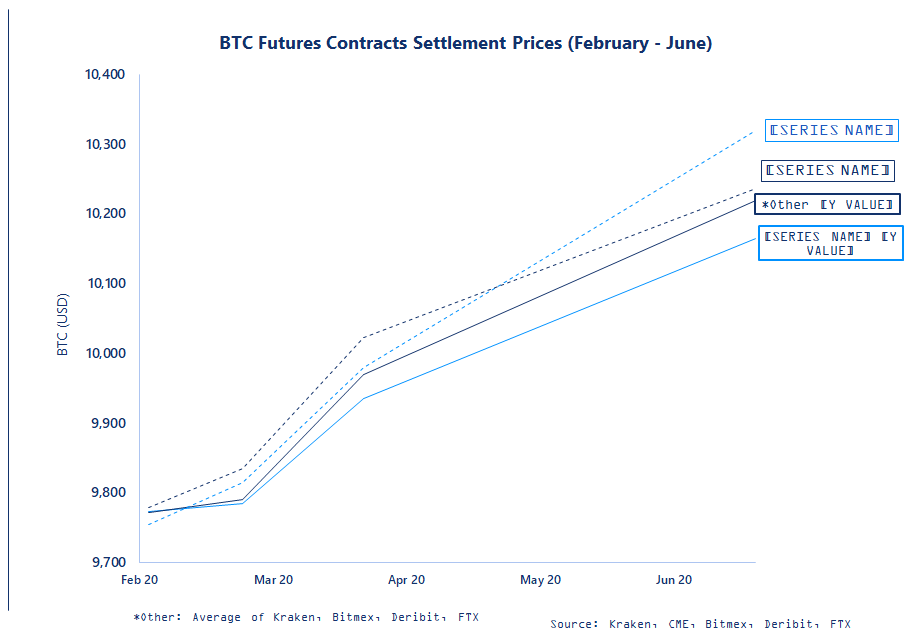

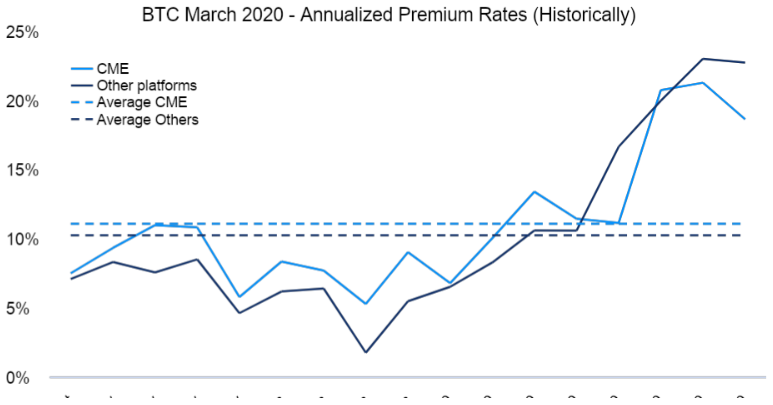

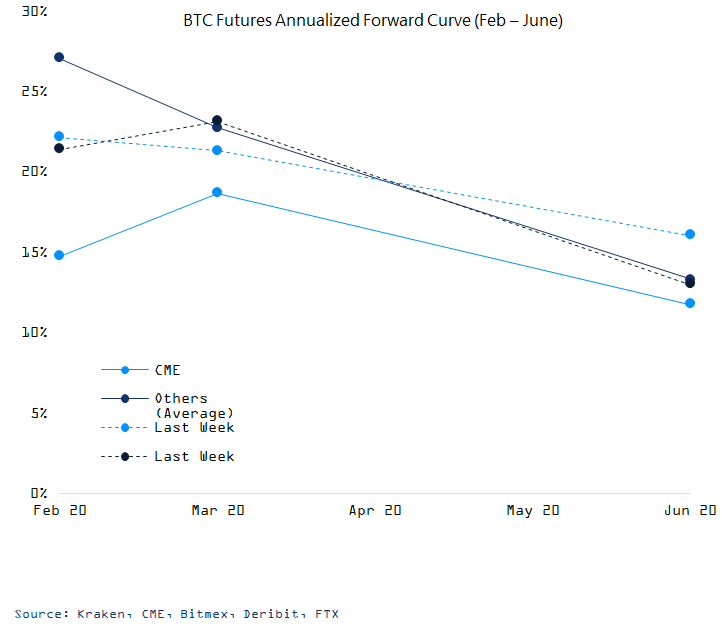

- The premium rates for BTC futures contracts turned more bullish for the retail platforms than CME recently. This trend continued last week.

- The premium rates on the June contracts are down almost 2 percentage points on CME.

- March premium rates are also down on all platforms, and retail stays ahead of CME.

RETAIL PREMIUM RATES SURPASSES CME FOR JUNE CONTRACTS

- As the BTC price had a large drop last week, the premium rates have been adjusting.

- Looking at June contracts, retail platforms are now seeing a higher premium than CME, flipped from the last update – indicating that retail are more bullish on a long-term horizon as well.

- The annualized premium rates for March are now between 18-23% and CME drops more than the retail platforms.

- All premiums are still far above the average, indicating a bullish sentiment among traders.

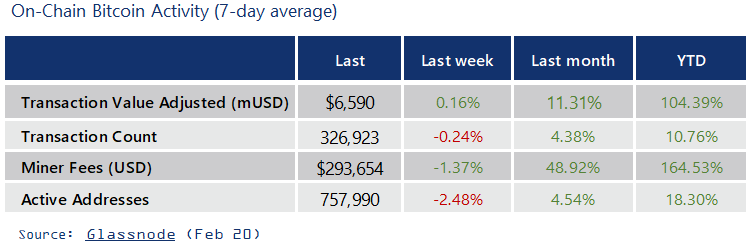

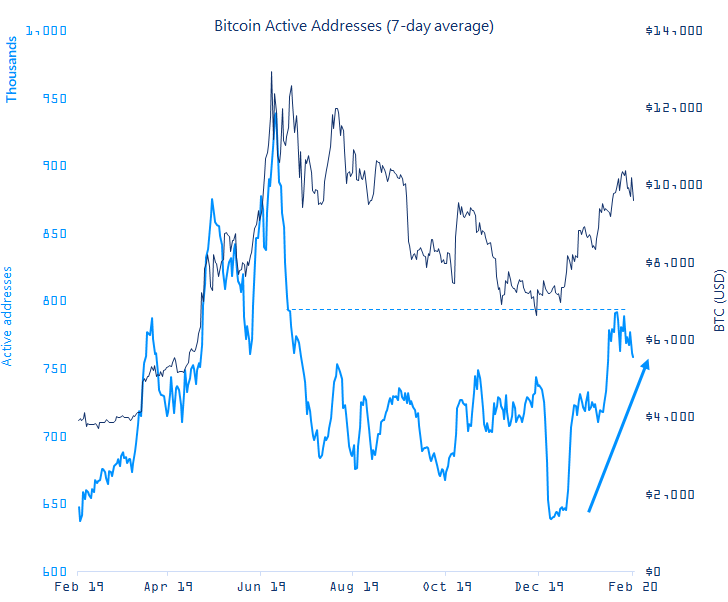

MORE MARKET PARTICIPANTS RETURNING TO THE BITCOIN NETWORK?

- Data show that the number of active addresses has been on the rise in 2020 and could indicate that more market participants are returning to the Bitcoin network.

- Active addresses is now at the same levels as during the peak in mid-2019, the highest in over half a year.

- Last time we saw this kind of activity on the Bitcoin Network, the price was touching levels around $12,000.

- Although seeing a small pullback lately, it looks like more participants are actively transferring bitcoin on-chain in 2020.

- As mentioned several times over the last couple of weeks, it is a healthy signal to see on-chain activity following the movements of the BTC price.