CORONAVIRUS TAKES US INTO THE UNKNOWN

This week’s Luno report highlights one key fact – we are heading into the unknown. For traders and investors the coronavirus has no parallel so trying to predict what will happen is almost impossible. The big question is whether cryptocurrencies will be used to diversify portfolios as the global impact of coronavirus continues to increase.

Last week cryptocurrencies responded in line with main asset classes. We saw a drop in value of all the major coins as investors recognised that the virus has gone global and cannot be contained in China. Volumes have reduced, the fear & greed index is at the lowest for two months and the CME Bitcoin Futures fell to a 2020 low. However, volatility is still high and many investors are deciding whether they will buy cryptocurrencies to reduce their correlation to the main markets.

We have always said that we do not see cryptocurrencies as safe haven assets, as they do not behave like gold or the yen. But, lack of correlation with the main markets and the fact that many people still believe that the next halving is not priced in, could lead to renewed interest in the major coins.

MARKET UPDATE

- Crypto and the Coronavirus – How will it evolve?

- Another bearish week in the crypto market

- Fearful market – Sentiment continues to drop

- Extreme premiums for Grayscale’s crypto products

- Increasing demand for commodity-backed gold tokens

- Ripple and XRP ripe for growth in the global remittance market

VALUATION

- Bitcoin could not hold important support level – What’s next?

- BTC premium rates continue downwards, as CME premium goes below average level for March contracts

BLOCKCHAIN ACTIVITY

- More room to grow for bitcoin based on on-chain transactions

- The bitcoin price may be far from a market top based on its “fair value”

CRYPTO AND THE CORONAVIRUS – HOW WILL IT EVOLVE?

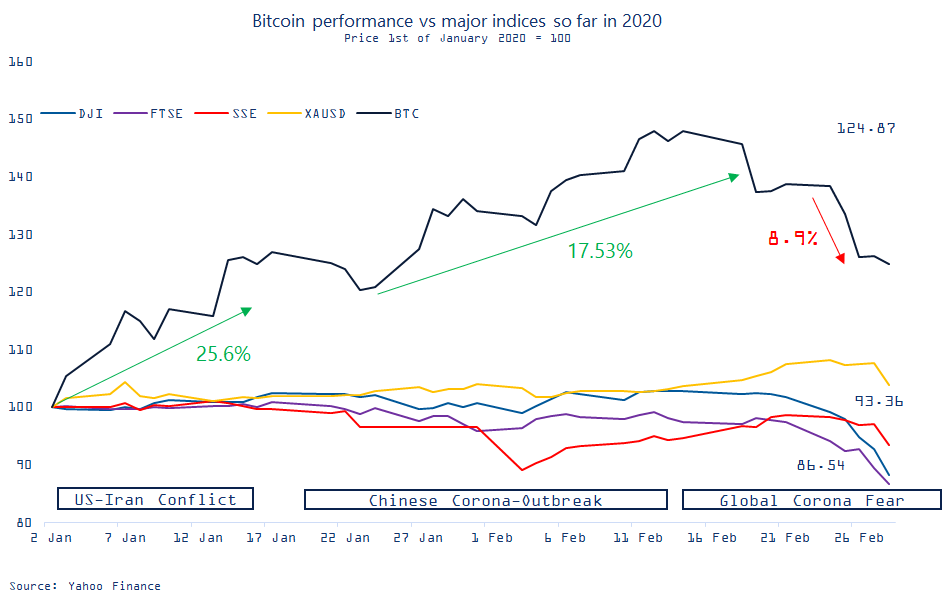

- Crypto delivered solid returns whilst the stock markets moved sideways during the US-Iran conflict and the Chinese Coronavirus outbreak .

- However, during the recent stock market crash following the global fears concerning the Coronavirus-outbreak, crypto fell sharply, and bitcoin shredded of 8.9% of its market cap within the first two days.

- The stock market crash forced investors to remove risk and to deleverage.

- The initial crypto sell-off indicates that entities from traditional finance are present in crypto, being forced to deleverage within their most risky assets first.

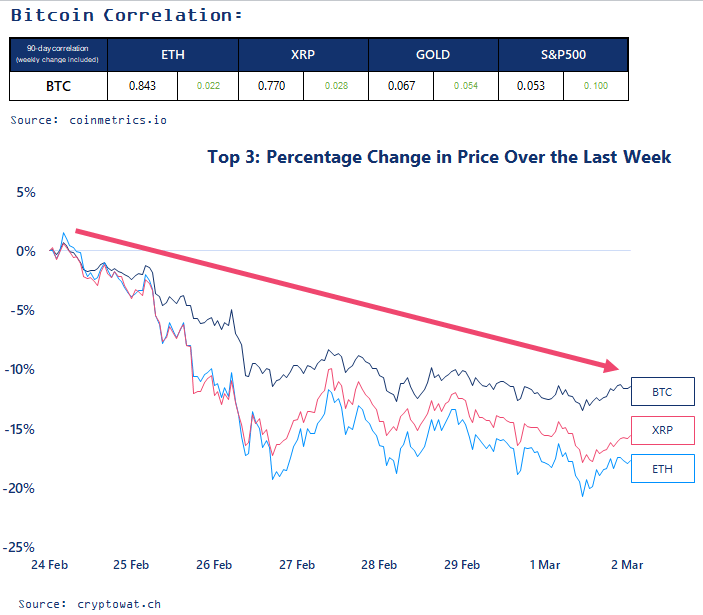

- This global deleveraging caused the short-term correlation between the bitcoin returns and the major stock indexes to rise. Bitcoin’s correlation to the DJI has so far in 2020 been 0.22, in stark contrast to the long-term correlation of -0.0266.

- However, bitcoin and other cryptos have historically showed to be uncorrelated with global financial markets. It is not unlikely that it will continue this way and present an interesting diversification tool for investors.

- The price stabilization of bitcoin after the initial sell-off might provide evidence of what’s to come, and could perhaps lead to some institutional investors starting to consider cryptocurrencies.

ANOTHER BEARISH WEEK IN THE CRYPTO MARKET

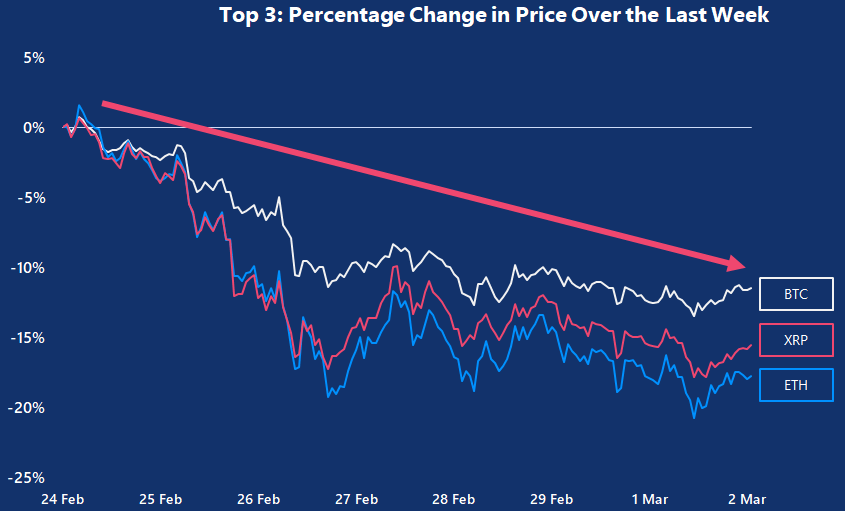

ALL GAINS FROM FEBRUARY WIPED OUT OVER THE PAST TWO WEEKS

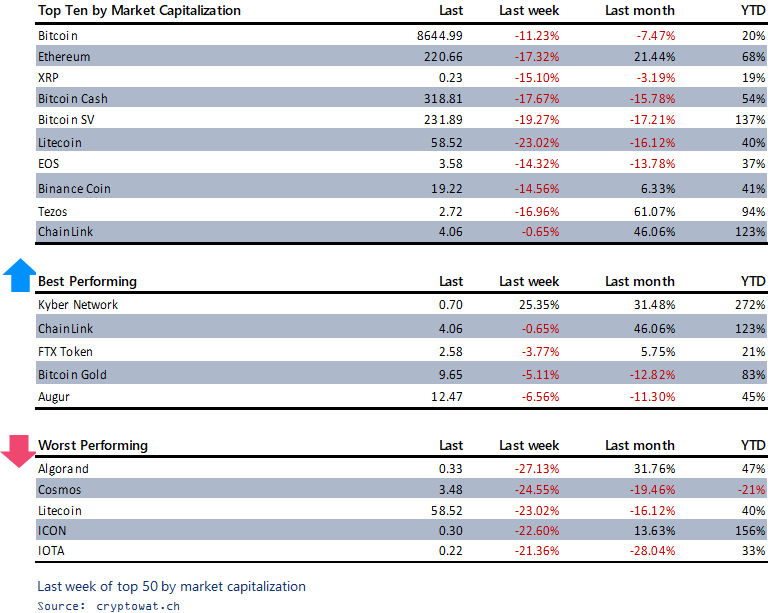

We just experienced another week with heavy losses, as most cryptocurrencies have lost all gains from February. This is quite an incredible turnaround within a month.

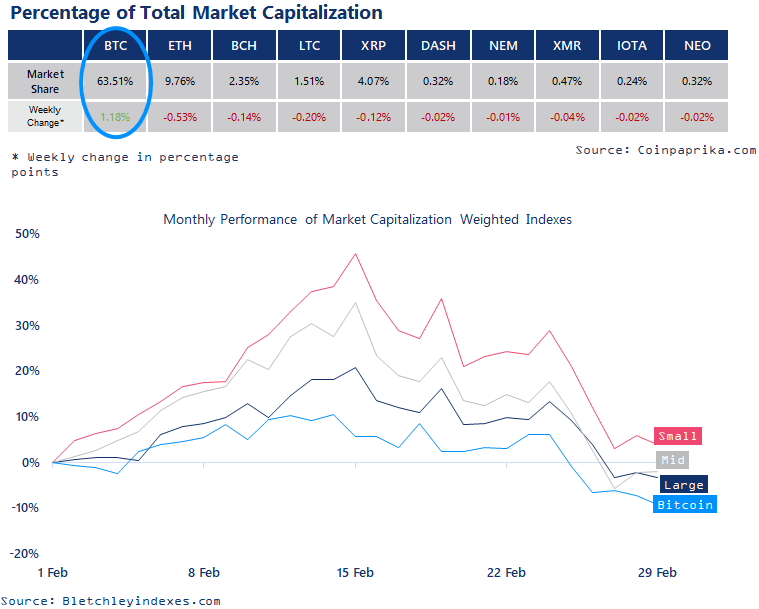

- Small Caps were up over 45% just two weeks ago but is now down to 4% gains in February. Still, this is the only index that’s trading at a higher level than in the beginning of the month.

- Large Caps, Mid Caps and bitcoin are all in the red, with bitcoin as the worst performer – down 9% so far in February.

- Bitcoin is showing strength, gaining overall market share this week.

FEARFUL MARKET – SENTIMENT CONTINUES TO DROP

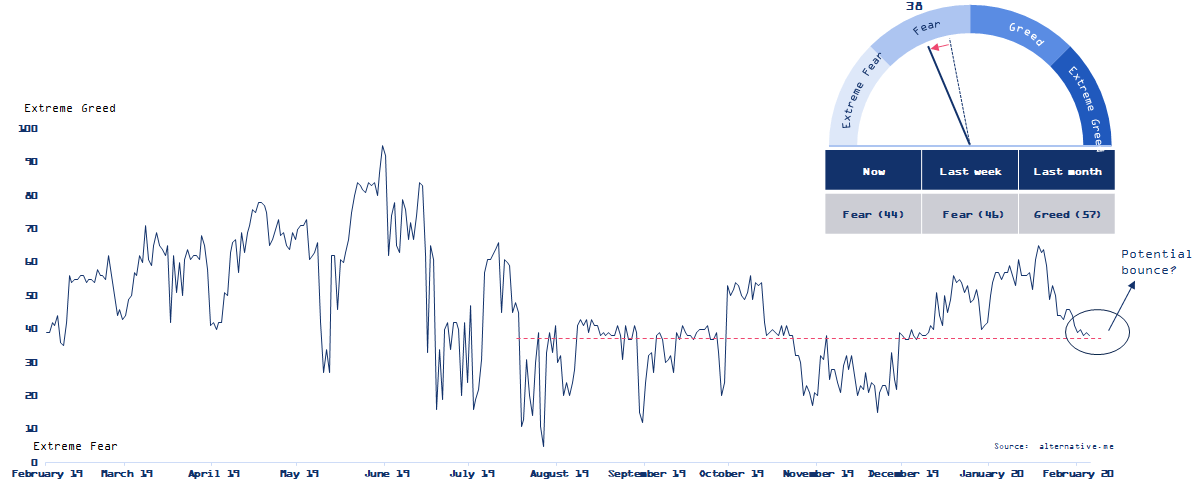

The Fear & Greed Index continued downward last week as the market is getting more fearful. The index is now down to 38, levels not seen in almost two months. With the recent pullback in the bitcoin price, new questions arise. Is this just a small pullback or will we continue to trend downwards again.

BITCOIN VOLUME DECREASES WITH FALLING PRICE

The 7-day average real trading volume* has been falling downwards again, as the bitcoin price has seen a larger pullback. This is actually normally seen as a bullish signal. Falling volume with falling price is an indication of weak support of the current price action.

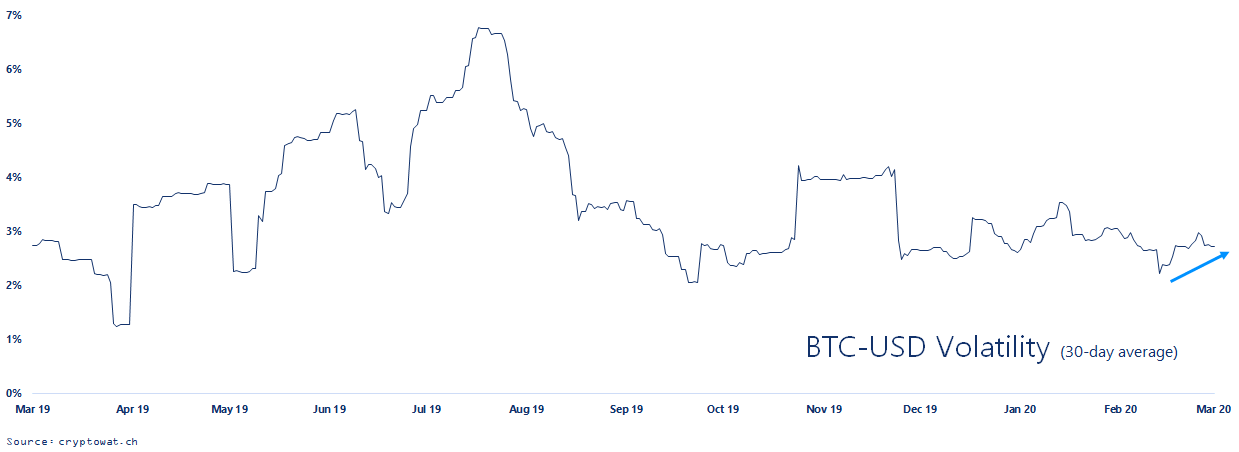

BITCOIN VOLATILITY HAS BEEN INCREASING FOR TWO WEEKS

The 30-day volatility has now been increasing steadily over the past two weeks since the local price top for bitcoin. The volatility is now close to 3% again, climbing from the bottom around 2%. This is a result of larger price drops lately, with several days seeing price drops of around 3-5% over the past two weeks.

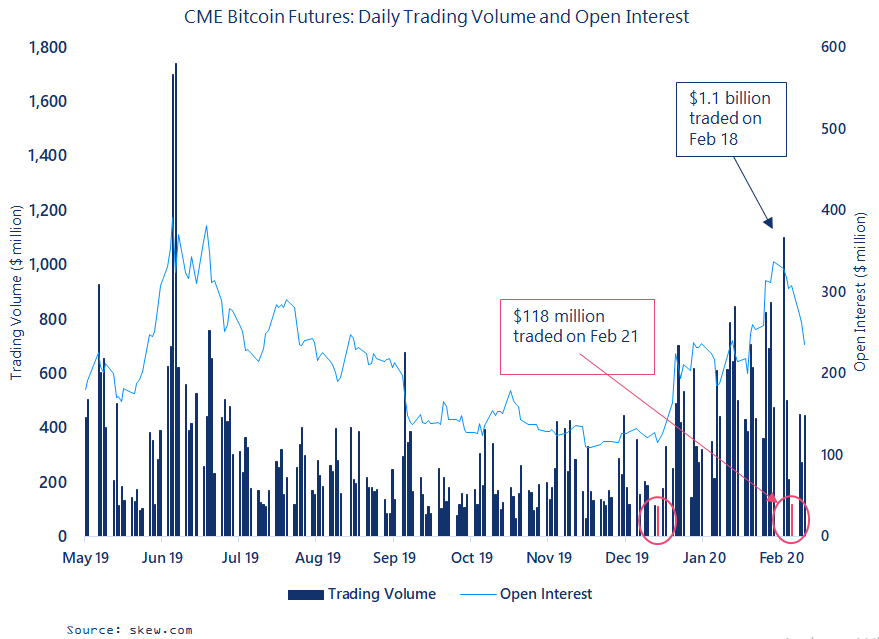

LOWEST CME DAILY VOLUME IN 2020

- A couple of day after the highest trading volume on CME since the peak in 2019, the volume suddenly dropped down to a new 2020 low.

- On Friday Feb 21, the daily trading volume for BTC futures was only $118 million.

- That is approx. 1/10 of the yearly record from Feb 18, when $1.1 billion were traded during the day.

- However, the daily volume recovered sharply and has been around $400 million this week.

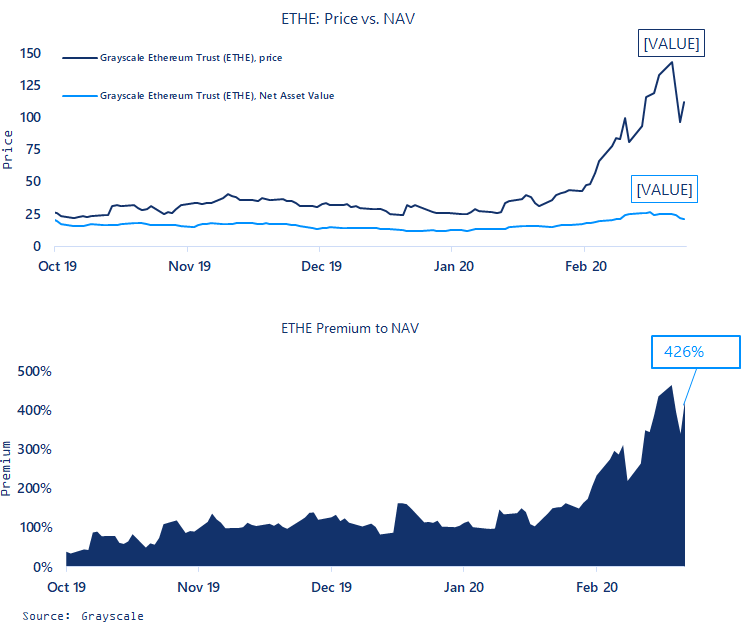

EXTREME PREMIUMS FOR GRAYSCALE’S CRYPTO PRODUCTS

- Investors in Grayscale crypto products are paying great premiums these days.

- In the Ethereum Trust, investors are paying $112.01 for the underlying assets worth only $21.29 – a premium of 426% to the Net Asset Value (NAV).

- The case is less extreme for the Bitcoin Trust, where investors pay $10.51 for the underlying asset worth $8.49 – a NAV premium of 23.9%.

- Why is this happening?

- Some may point towards an increasing demand that is pushing the price far above NAV, but there is probably a much more “neutral” explanations to this story.

- Grayscale’s products are structed with a lock-up period and is most likely the reason why markets aren’t clearing here. Structural limits to arbitrage.

- Hence, this doesn’t mean that markets aren’t efficient in this situation, but could mean that markets aren’t clearing (removing the premium) for specific reasons.

- It will be highly interesting to see how these market prices react when large portions of the invested funds are cleared of the lock-up period.

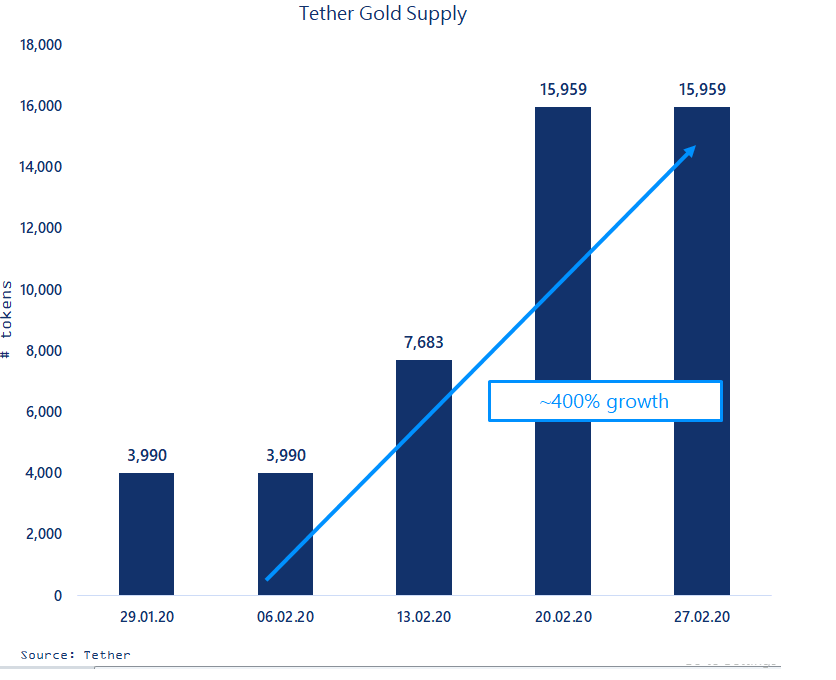

INCREASING DEMAND FOR COMMODITY-BACKED GOLD TOKENS

- The Tether Gold token (XAUT) was launched by Tether on January 24th, this year.

- One token represents the ownership of one troy fine ounce of physical gold, held in a Switzerland vault.

- Blockchain information for the Ethereum contract showed a supply of nearly 4,000 tokens at launch

- One month later, on February 24th the supply of XAUT had quadrupled to nearly 16, 000 tokens.

- This suggests a great demand for commodity-backed tokens which perhaps could emerge as one of the major trends in the crypto space.

- Commodity-backed tokens gives crypto investors new opportunities within portfolio management and diversification on cryptocurrency exchanges, as more uncorrelated assets are available as trading pairs.

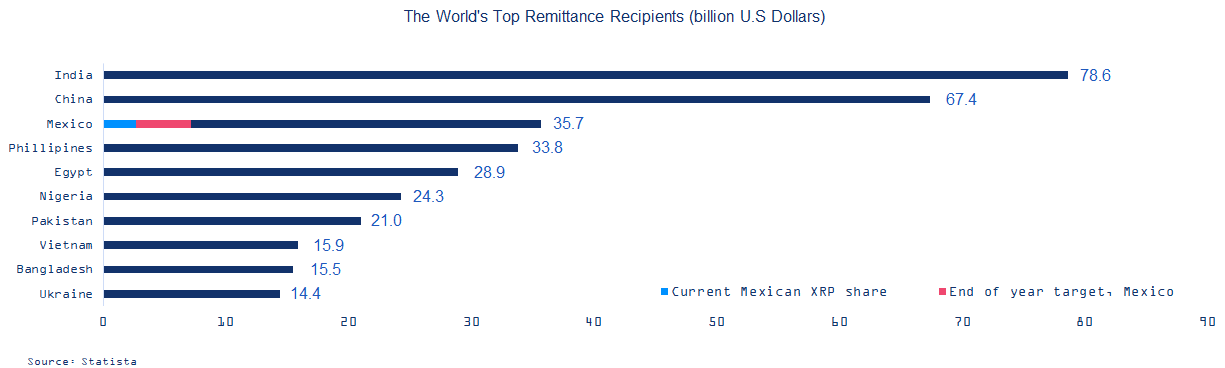

RIPPLE AND XRP RIPE FOR GROWTH IN THE GLOBAL REMITTANCE MARKET

- XRP has become a significant part of the Mexican remittance market, accounting for about 7.5% of the total amount of money transferred into Mexican Pesos this February.

- Ripple has partnered with Bitso, the largest Mexican cryptocurrency exchange. Since October 2019 the XRP share of the Mexican remittance market has increased steadily from about 2% in October, to its current levels of 7.5%.

- Only 17.6% of the Mexican population has an active bank account, making cryptocurrency transfers one of the most feasible and low-cost bearing remittance methods available.

- David Vogel, the CEO of Bitso has stated that his goal by the end of the year is that 20% of all US-Mexico transactions (7.14$ billion) would be handled by Bitso via XRP.

- Ripple focuses on strengthening its position in the global remittance market and recently introduced a partnership with RAKBANK, BDO Unibank and Azimo in order to expand into the Philippine remittance market. Ripple is also currently expanding to India via MoneyGram and Egypt via The National Bank of Egypt.

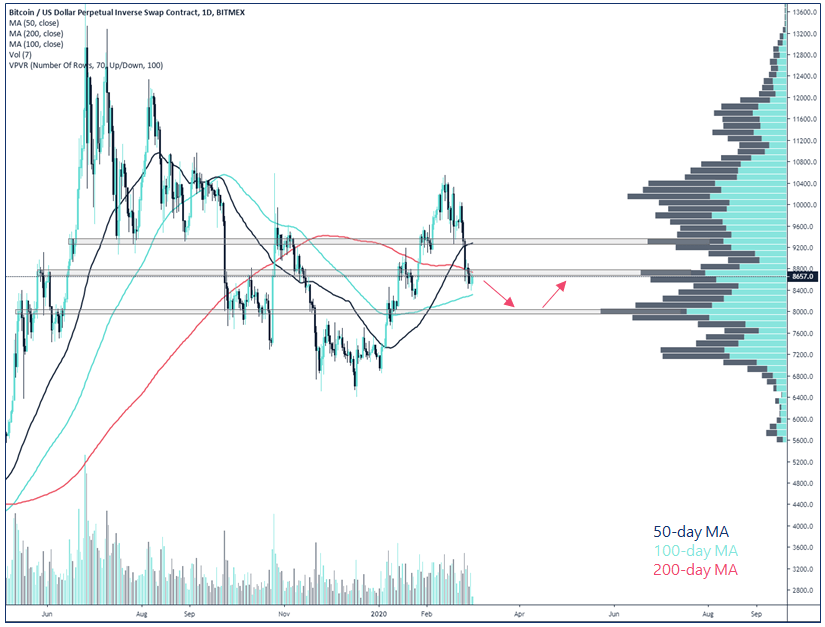

BITCOIN COULD NOT HOLD IMPORTANT SUPPORT LEVEL – WHAT’S NEXT?

- The bitcoin price continued downwards this week and did not find support on the 200-day moving average (200DMA).

- The support on the 200DMA is usually strong, and breaking this is a bearish signal.

- Right now, it looks lite the bitcoin price is headed downwards to the 100DMA around $8,3000.

- The price could go all the way down to $8,000, where there has been a lot of trading activity historically.

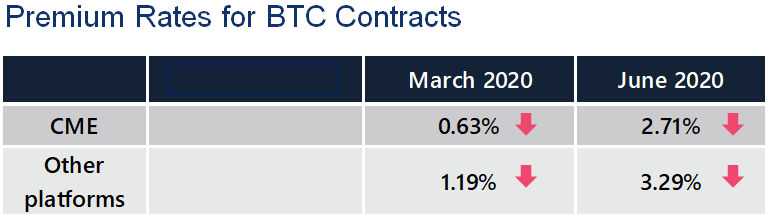

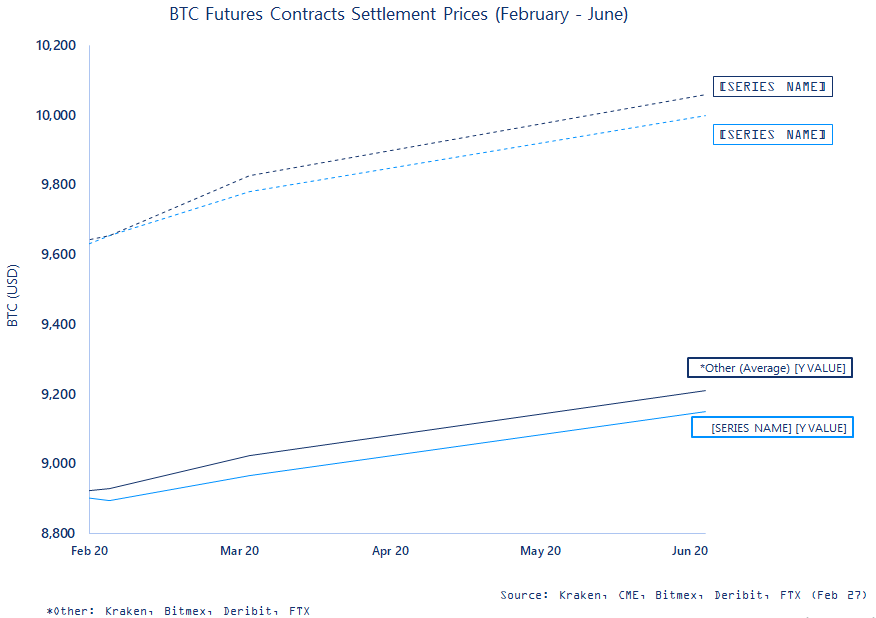

PREMIUM RATES CONTINUE DOWNWARDS

- With the recent price drop for BTC, the futures premium rates have been following.

- The market is definitely less bullish for the outlook until June.

- Just two weeks ago, the premium rates for March were as high as the June premiums are today.

- Retail stay more bullish than institutions for yet another week.

PREMIUM RATES ON CME BELOW AVERAGE

- The BTC futures premium rates for March have seen a major pullback lately.

- The annualized premium rates for March is now cut down to only 7% on CME. This is below the average level, which hasn’t been observed since the beginning of January.

- The recent price pullback has really hit the premium rates, and only time will tell if this is an over reaction or if traders truly are less bullish on the upcoming months.

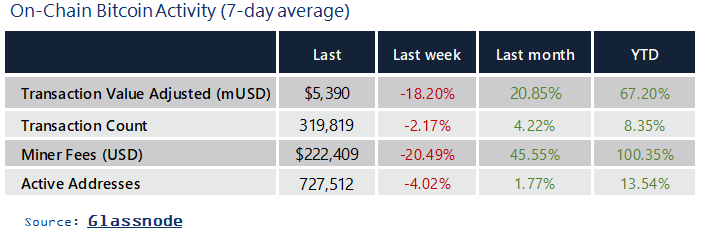

MORE ROOM TO GROW FOR BITCOIN BASED ON ON-CHAIN TRANSACTIONS

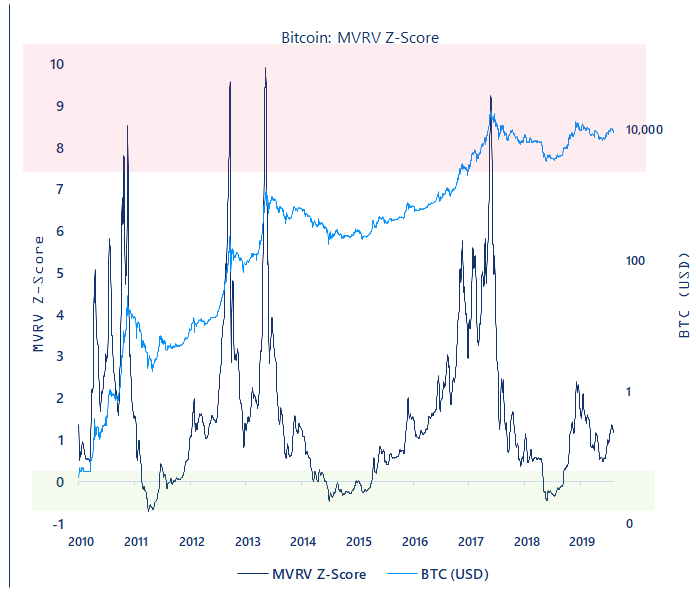

- Data show that the bitcoin price may be far from a market top based on its “fair value”.

- The MVRV Z-score is used to assess whether bitcoin is overvalued or undervalued relative to its “fair value”, which is underlined by its realized cap. Realized cap values transaction based on the price when they were last moved.

- Technically, MVRV Z-Score is defined as the ratio between the difference of market cap and realized cap, and the standard deviation of market cap,

i.e. (market cap – realized cap) / std(market cap). - When the MVRV Z-score is too high (red zone), this usually indicates market tops, while a lower ratio (green zone) could indicate market bottoms.

- The current score for bitcoin could then indicate that there is still more room to for the bitcoin price to grow, and that bitcoin is still undervalued.

- However, these are just indications based on on-chain activity and do not including activity off-chain, like exchanges.