We recently reported that the economic downturn and technical recession could be a reason for South Africans to turn to digital assets as a hedge against weakened buying power. We now have further evidence to support this proposition.

Leading cryptocurrency company Luno commissioned an independent research firm, Kantar TNS, to survey consumer habits and attitude toward digital assets. And the reality is: It confirms what many of us in the industry knew, that cryptocurrency is reaching critical mass.

While there may be a number of arguments currently in circulation about Bitcoin and other cryptocurrencies negatively affecting the climate through their energy-intensive “proof of work” infrastructure, it would seem that the practical solution cryptocurrencies offer the consumer outweigh any negative connotations. At least for now, anyway.

Luno announced the findings of this independent survey on Friday 2 November at a media briefing in Sandton, and the results are fascinating for South Africans. 11 countries were surveyed, and South Africa was in the top tier for awareness and adoption in most of the categories.

Listen to an Global Crypto podcast featuring Luno’s head of SA Business as well as leader of African Expansion after the media briefing:

South African Crypto Dominance

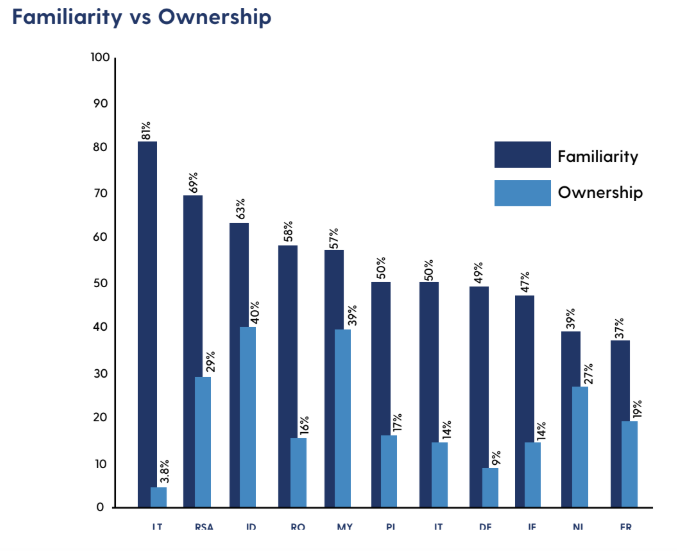

Of the 11 countries, South Africa had the second highest percentage of cryptocurrency awareness, with 69% of South African respondents saying they were aware of cryptocurrencies. Whilst placing third for ownership, at 29%. Interestingly, Lithuania ranked highest for awareness, at 81% of respondents, whilst ranking last for ownership (3.8% of respondents). This could be attributed to the difficulty of purchasing cryptocurrency in Lithuania.

One could also argue that South Africa’s dominance in the survey is because most internet users in SA are already somewhat technologically advanced in order to be connected to the internet itself, and thus would be more comfortable with experimenting with cryptocurrency (over 40% of South Africans still don’t have access to the internet). Another factor could be that the barrier to entry in South Africa is low, with a number of cryptocurrency exchanges available to the public. Perhaps the ubiquity of networking marketing schemes are also a significant contributor?

An important fact to take note of in the above results graph is that the leaders are all developing countries, whilst the developed markets all come in below these emerging economies. Poland, Italy, Germany, Ireland, Netherlands and France all come in behind Lithuania, RSA, Indonesia, Romania, Malaysia for crypto awareness, and by some way, too. With cryptocurrency awareness 7% higher in Malaysia than in the first developed nation on the list, Poland.

Again, one could argue the fact that overall internet users in emerging markets are more technologically advanced than their developed counterparts. Or could it be, as Luno seem to interpret, that emerging markets are more aware of potential economic alternatives to their own weakened currencies?

However, it’s a different read when looking at ownership. Three of the top six in terms of ownership are developed countries, which probably indicates more disposable income with which to purchase cryptocurrencies coupled with the availability of exchanges.

Which Cryptocurrencies Lead?

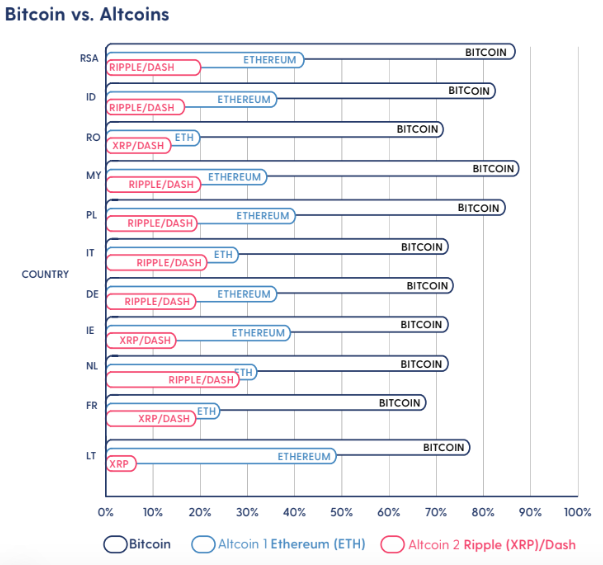

As indicated in the below graph, there wasn’t much surprise by way of which cryptocurrencies led the way. Bitcoin came out on top as the most known and owned by a long way, with Ethereum coming in a distant (surprisingly) second. The Netherlands clearly has a more developed understanding of cryptocurrency, as “Altcoin 2” (which referred to either DASH or XRP as listed in the survey) was a very, very close third behind Ethereum, whilst being a distant third place in most of the other markets.

Honing In On South Africa

When observing the South African results specifically, we can see that there is still a lot of mistrust in the industry. 48% of respondents said that they were concerned about losing money due to a transaction error or scam, whilst 47% stated that they would buy cryptocurrency if they could purchase it from a trusted supplier such as a bank. This proves that while many cypherpunks want to see a truly decentralized monetary system, true global adoption will most likely only happen when the general public see reputable brands and institutions supporting cryptocurrency. Whether that’s a good thing or a bad thing can be left for another opinion piece.

What was an interesting stat was 74% of South African respondents saying they’d like to pay with cryptocurrencies at an outlet, whether that be online or brick & mortar. One wonders why the other 26% wouldn’t, or if this was the way the survey was structured?

18% of South Africans said they had no interest in owning a cryptocurrency, which is fairly high considering the trend of cryptocurrency growth. Is this is a number that is set to fall in coming years? Or does this indicate that digital assets are really just another commodity like gold and diamonds, that seem certain people just have no interest in owning?

Other key takeaways among the South African respondents:

83% of owners see it as an investment

23% use cryptocurrency for online transactions

12% use it to transfer money (or in this case: value)

40% believed that cryptocurrency is a safe investment

61% believed cryptocurrency is a profitable investment (this seems high)

80% of South African men are familiar with cryptocurrency, whilst 58% of women respondents are familiar with it.

CONCLUSION

All in all, these stats provide solid evidence that cryptocurrency is on the rise. More and more people are coming to know about it, and more and more people want to own and transact with it. A significant key to market saturation is the policy of big banks and regulators. We are still in the early throes of an entirely new industry, and how the large institutions respond will directly impact cryptocurrency’s performance – in both price and adoption.

Bottomline: Emerging economies are the ones to look out for. The public in these markets are clearly searching for alternatives to their national currency in the event of an economic collapse such as those of Argentina, Greece or Venezuela.

It is fair to say that as we’ve seen with the likes of Malta and Isle of Man, the markets that open their arms to cryptocurrency adoption will likely position themselves as global leaders for what seems to be an inevitable transition to a new economy.