Global Crypto’s Financial Analyst has an interesting trade this week. In this week’s analysis (which you can watch here), he says that he sees a potential parabolic move imminent, but then writes after the recording that it’s important to note that this is 50/50.

Due to the high Risk to Reward Ratio, Graeme has opened a trade based on his analysis, but after recording the episode, there was some downward movement. This downward movement has caused Graeme to reassess, and has made him a little more bearish on the short term, but ultimately it didn’t stop him out of the trade, and thus he is keeping the trade open.

Graeme then wrote a detailed explanation of the downward movement, and elaborates on why he is keeping his original trade open…

As noted in our recording with James, this trade is a 50/50 trade, so it’s extremely important to manage risk accordingly. Even though I’m probably a little more bearish on the short-term, the Risk to Reward Ratio is so high, that it’s worth staying in the trade.

As explained in the recording, this analysis is based on a symmetrical triangle playing out on the macro level of the Bitcoin chart, going back all the way to early 2017…

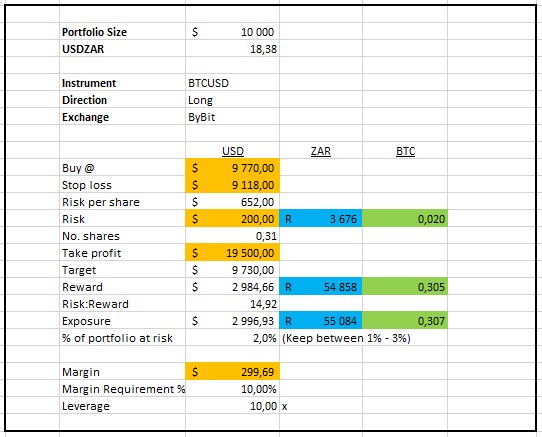

This was my original trade setup. This gives you an indication how I structure my risk management parameters…

I was not stopped out on the most recent sell-off fortunately.

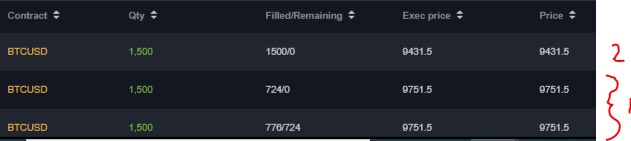

To achieve the RRR according to the setup, I need a total exposure of $3000. I split my entry across two orders -> $1500 @ 9751.5 and $1500 @ 9431.5…

So the last sell-off allowed me to better my average buy price which is now $9588.83. So my RRR is actually now 21.85:1

i.e. 21.85 units of reward for every 1 unit of risk

If I had this setup on Bitstamp, I would have been stopped out. Not saying that one exchange is better than another, just that pricing can differ across exchanges. On this occasion I was fortunate.

So, I’m happy with my entry and this may all sound pretty rosy so far, but this most recent sell off has broken a short term trend line and makes for a rather precarious situation with my stop being so tight. This could well be the first short term “impulse candle” that gets the price moving lower after testing the support turned resistance at 9550 which is what is happening now.

In my favour, the sell-off did get bought up pretty quickly (as has been the case for the last number of days) showing that there is good buying appetite in the levels above my stop.

Case in point – if my risk reward ratio is 10:1, I only need to have a win rate of 9% to breakeven.

Even though I’m long, I’m marginally bias toward us heading down. Hope the above explanation can justify that dichotomy! 🤔

After recording the analysis with James, I watched this video of Raoul Pal’s interview of Peter Brandt – bookmark it on YouTube for later (after you watch our analysis below 😉).

Raoul Pal of course is a macro hedge fund manager and founder of Real Vision Finance Media (And incidentally will be making an appearance on the next Global Crypto Podcast with James in the coming days!). Peter Brandt of course is a respected technical analyst.

Disclaimer: Raoul and Peter highlight the macro symmetrical triangle that I discuss in my analysis as well. Again, I watched this video after doing the Global Crypto market analysis, so it wasn’t a copy-paste. That said, the macro symmetrical triangle is now gaining more attention and I’m not the first one to highlight it. The first person I heard speaking about this setup was Francis Hunt (aka The Crypto Sniper). He’s a brilliant TA and well worth subscribing to on YouTube here.

And that’s where we stand. Please remember all the standard Ts & Cs and risks of trading! Be safe!

And watch (and subscribe) to our latest market analysis with James below: