Media Release: Monday, 4 May 2020, 11:00 CAT | Source: Luno

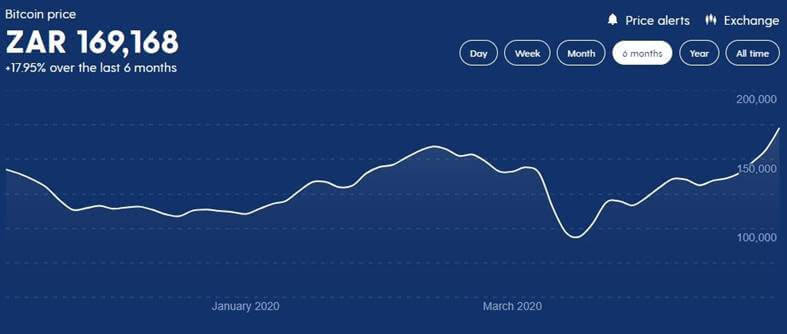

The cryptocurrency sector continues to show strong growth despite a weak global economy. Over the past month. Bitcoin is up 28% and is now trading at R169,000. Despite severe economic contraction since the global Covid-19 pandemic, this sector is acquiring new entrants, reporting higher trading volumes and presenting a more compelling use case. Transmission of Covid-19 via surfaces is incentivising society to move towards a cashless environment which augurs well for digital money.

According to South Africa’s largest cryptocurrency exchange, Luno, record trading volumes were achieved in March and there was a 50% rise in its number of active users month-on-month. Luno has over 3 million users across 40 countries worldwide.

Marius Reitz, GM for Africa at Luno, says, “This indicates continued cryptocurrency investment by existing holders and entirely new investors entering cryptocurrencies for the first time.”

Increased demand

Reitz adds that a recent client survey, undertaken during the pandemic, also highlighted 42% of Luno wallet holders plan to buy more and 41% plan to trade in the next six months. “Over 4,000 customers responded to our survey. They indicated that they are planning to increase their crypto holdings or trade in the next six months, while less than 6% plan to sell. Interestingly, 70% of inactive customers want to automatically invest a fixed amount in cryptocurrencies, indicating that they are moving closer to traditional investment models,” he says.

Central banks and regulation

The cryptocurrency industry’s growth and maturity becomes more evident as countries around the world investigate their own central bank digital currencies. In addition, regulators continue progressing regulations for the industry. South Africa’s draft regulation framework is currently open for public comment until 15 May 2020.

“Luno welcomes regulation as it will provide comfort to consumers and professional service providers such as banks and auditing firms that the company they are dealing with is held to defined regulatory standards. Regulation in the industry can have a very positive impact. Imposing regulations in South Africa and across the world will enhance general trust in and stability of this market. It will likely result in even more talent and investment capital flowing into the industry, unlocking more business models and bringing more advanced products to market,” says Reitz.

Attracting top talent

The sector continues to attract and retain top talent worldwide, with high calibre candidates with scarce skills joining cryptocurrency companies, ranging from software developers and security specialists, to financial, legal, and compliance experts. “In many cases, crypto companies are building their teams with candidates from legacy companies,” says Reitz.

The Luno Learning Portal is a free guide for anyone looking to take their first steps into the world of digitised assets.

— – – – – – – – – – – – – – – – – – –

This article is a Media Release received from Luno. Global Crypto did not receive any form of compensation for its publication, and as this material is deemed newsworthy for the Southern African blockchain industry, it was thus published accordingly.