Dear Investors,

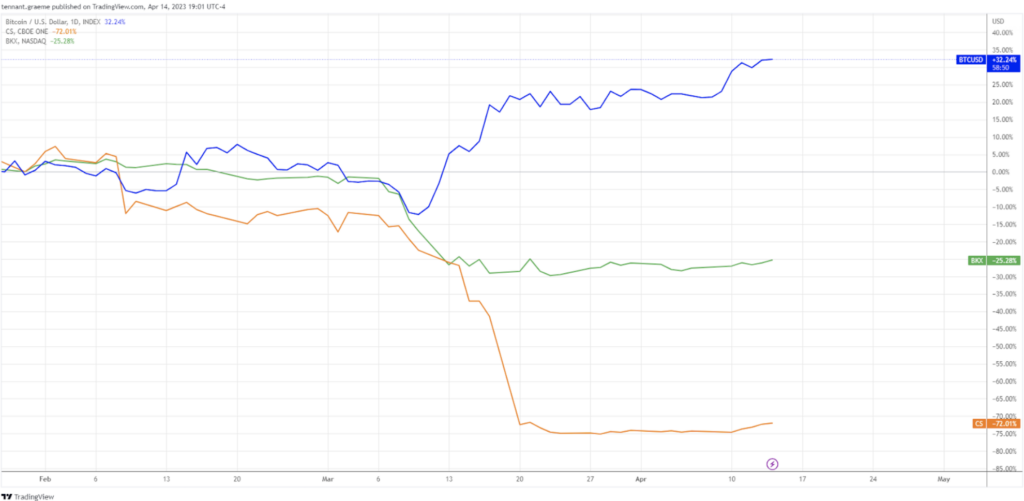

The positive start to the year for digital assets continued in the month of March with Bitcoin up 22% and the Crypto 100 Index up 12%. This highlights Bitcoin’s relative outperformance compared to the rest of the digital asset market as it has enjoyed the support of investors off the back of market fears regarding bank failure.

Long Bitcoin, Short The Banks

The failure of Silicon Valley Bank (SVB) and Credit Suisse is the latest event highlighting the fragility of the traditional financial system and the case for Bitcoin in particular under such circumstances. Before considering some of the recent developments, I feel it’s worth revisiting recent history to understand what led us here.

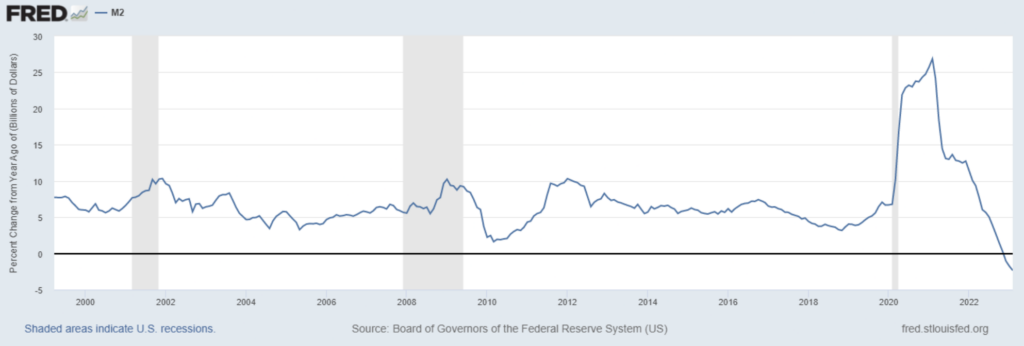

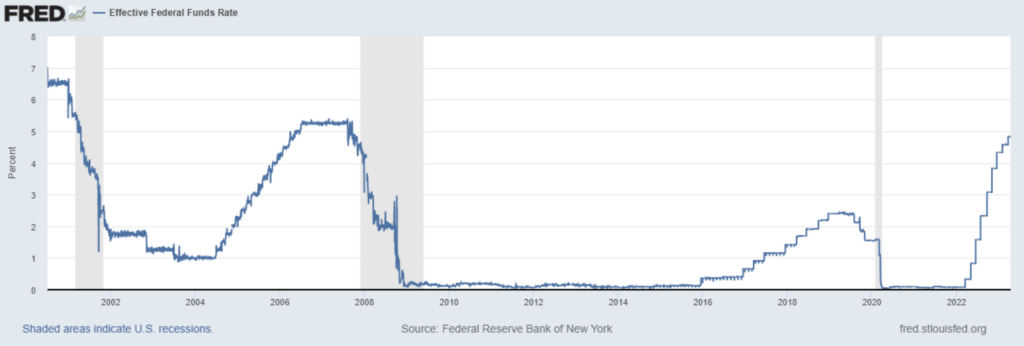

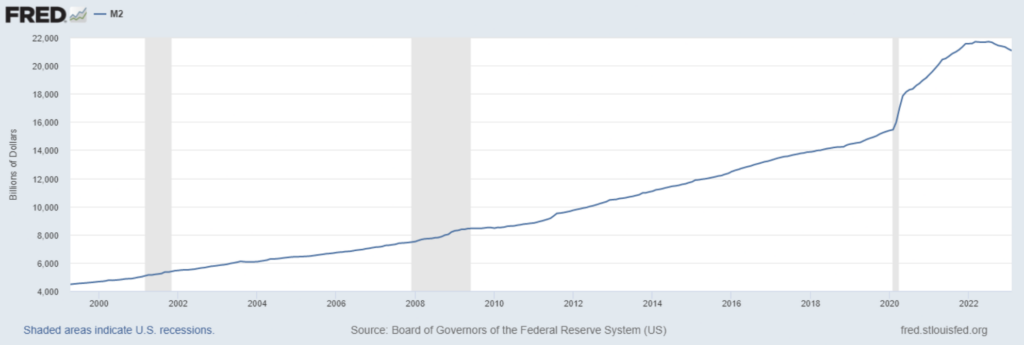

In response to concerns regarding the health of the global economy during the period of the Covid-19 pandemic, the US Federal Reserve (FED) took the action of implementing a policy of extreme monetary stimulus. The FED created $5.2 Trillion in response to Covid-19, increasing the money supply (M2) by 25% within a 12 month period, as illustrated below. Further to the relief offered by fiat money creation, the FED also reduced interest rates from an already meager 2% to effectively 0%.

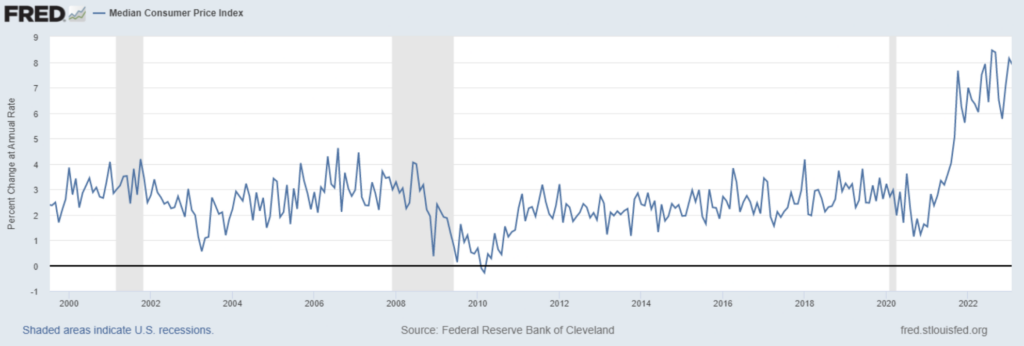

What followed afterwards was a boom in the nominal prices of assets across equity markets, real estate, commodities and digital assets, buoyed by easy money and low borrowing costs. Unfortunately, the party can never carry on indefinitely and the animal which would bite the hardest was inflation. US CPI, the official government measurement for price inflation, rose from around 2% post-Covid to over 8% in 2022 – levels of inflation not seen since 1982!

Since the beginning of 2022, with inflation running hot and Covid fears allayed almost as quickly as they initially arrived, the FED embarked on an interest rate hiking cycle as well as a reduction in fiat money creation relative to the Covid era money bonanza. Successive interest rates hikes ensued, bringing the Federal Funds Rate up to almost 5% today.

The current monetary system works in such a way that for every $1 of new fiat money created, $1 of new debt is created and furthermore, this debt incurs interest.Therefore, when large amounts of new fiat is created, as was the case in response to Covid, large amounts of new debt is created too. The total US debt before Covid was $23T which now currently stands at $31T after Covid – almost a 35% increase in a little over 3 years. Then when the FED elected to raise interest rates in an attempt to quell inflation, there was now a significantly greater debt pile to service and value at a higher prevailing interest rate.

It is against this backdrop of rising interest rates on a vast debt pile and the absence of central bank fiat creation that the weakest players in the banking system start to feel the heat. SVB was the biggest US bank failure since the Global Financial Crisis, leading to a sudden intervention by the Fed. A buy-out for the failed Credit Suisse was rushed through by Swiss authorities to avoid further contagion, bringing an end to its 167 year history.

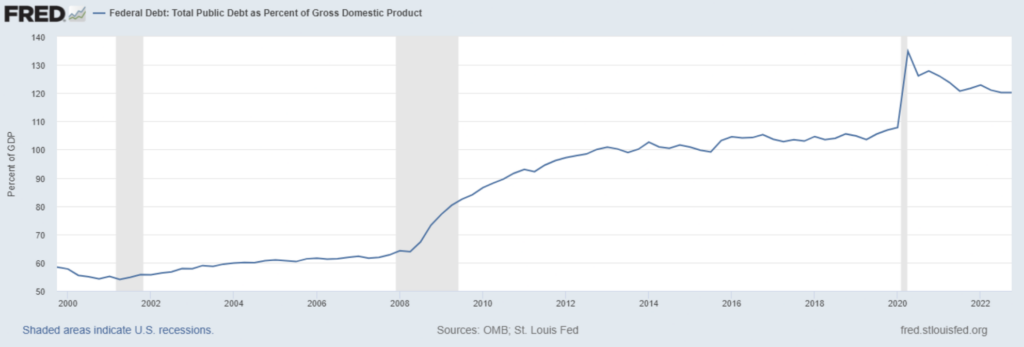

Since then, the dust appears to have settled for now on the banking front, but does this give the global financial system the all clear? One means of measuring the financial health of a country is to observe its debt-to-GDP ratio. Gross domestic product (GDP) is a measure of the total value of all goods and services produced by a country’s economy in a year which also serves as an indication of the value against which a country can raise taxes. Given that taxes are a country’s primary source of revenue, comparing a country’s GDP to its debt gives one an idea of a country’s ability to service its debts.

As the chart of the US debt-to-GDP ratio reflects, the trend is up and to the right! A debt-to-GDP ratio of more than 120 is considered by many notable economists to be unsustainable.

Given the precarious situation of the global financial system, we believe it is fair to expect the system to show further stress in time, in the form of banking crises and the like. Ultimately, we suggest that investors need to position themselves for periods of high inflation, high volatility and high risk. This can be achieved by diversifying a portion of one’s investment portfolio into assets which are likely to outperform traditional asset classes like equities, bonds and cash in such conditions. Bitcoin specifically and digital assets more broadly, are positioned to perform well in a systemic crisis situation of which we had a small taste of in recent weeks.

The graph below shows the Bitcoin price in blue compared to the Nasdaq Bank Index (BKX) in green and Credit Suisse in orange from Feb 2023 to present.

Portfolio Positioning

Spectrum returned 14.02% for the month of February whilst Bitcoin and the Crypto 100 Index (CI100) returned 22.00% and 12.02% respectively.

Given that Spectrum aims to hold a diversified portfolio of digital assets, the fairest measurement of Spectrum’s relative performance is against a market weighted crypto index, most appropriately reflected by the CI100. When BTC dominance is rising, it will be very difficult for a portfolio of diversified holdings to keep pace with the relative strength of a single asset. Obviously, the reverse applies in Altcoin driven bull markets which are conditions where Spectrum has historically outperformed Bitcoin.

Spectrum’s digital asset exposure for the month was maintained below 75%. This is significantly lower than the beta exposure of the CI100 which is comprised of approximately 90% volatile digital assets and 10% stablecoin. Despite Spectrum’s lower beta during the month and hence lower market risk, Spectrum managed to outperform the CI100 which is a pleasing result. This was achieved by holding an overweight position in Bitcoin (BTC) as well as a notable holding in Ripple’s native token XRP which both outperformed the general digital asset market.

If the market’s upward trajectory continues, we will be looking to pivot into Ethereum and DeFi related Altcoins at the appropriate time. We expect that a successful upgrade for Ethereum in the upcoming Shanghai/Capella hard fork will likely see ETH and associated Ethereum project tokens catch a bid.

Looking Forward

We foresee tremendous value in the potential for Bitcoin and digital assets to offer an alternative store of value and better financial infrastructure compared to the traditional monetary and financial systems. The digital asset industry still requires a great deal of growth and maturity before one could see it offering a realistic replacement to the current legacy systems and this will obviously take time. Therein, however lies the opportunity – an investment into digital assets against the backdrop of the sunset banking industry fraught with terminal frailties, remains in our view, the most exciting investment opportunity of any asset class.

As such, we strongly believe that digital assets have an important place in one’s investment portfolio and that Spectrum is the best way to allocate to this asset class.

We thank you for your continued trust in us and we look forward to updating you with our progress again next month.

Sincerely,

The Stewards Spectrum Investment Team