On the back of the most damaging health pandemic in a century, the global economy appears to be on its knees. Central bankers the world over are desperately trying to stimulate their respective nation’s economies, and in some parts, it’s worked. But this is only a temporary solution says our Financial Analyst Graeme Tennant.

It is entirely unsustainable to continue adding to a central bank’s balance sheet, especially as aggressively as the Federal Reserve Bank of the USA is doing.

Eventually that balance sheet will come knocking.

All we are seeing now are complex financial lifeboats propping up the various markets, while retail investors rush to get in on the short-term bullish action. It is inevitable that these markets correct themselves, and when they do, it won’t be pretty.

“This is why I am so fundamentally bullish on Bitcoin,” says Tennant. “Its decentralised, open source, and deflationary nature make it a perfect alternative when traditional markets are in free fall, which we have already seen in its adoption in Africa, Venezuela, and Argentina.”

The Federal Reserve’s recent buying of junk bonds is just another desperate attempt to keep things from dismantling, but soon there will be no more straws left to clutch onto.

Despite his fundamental reasons for a bullish Bitcoin, Graeme says the short-term is extremely hard to predict. While traditional markets are running off the back of the Fed’s stimulus packages, Bitcoin is being left out by retail investors as they opt to cash in on these stimuli.

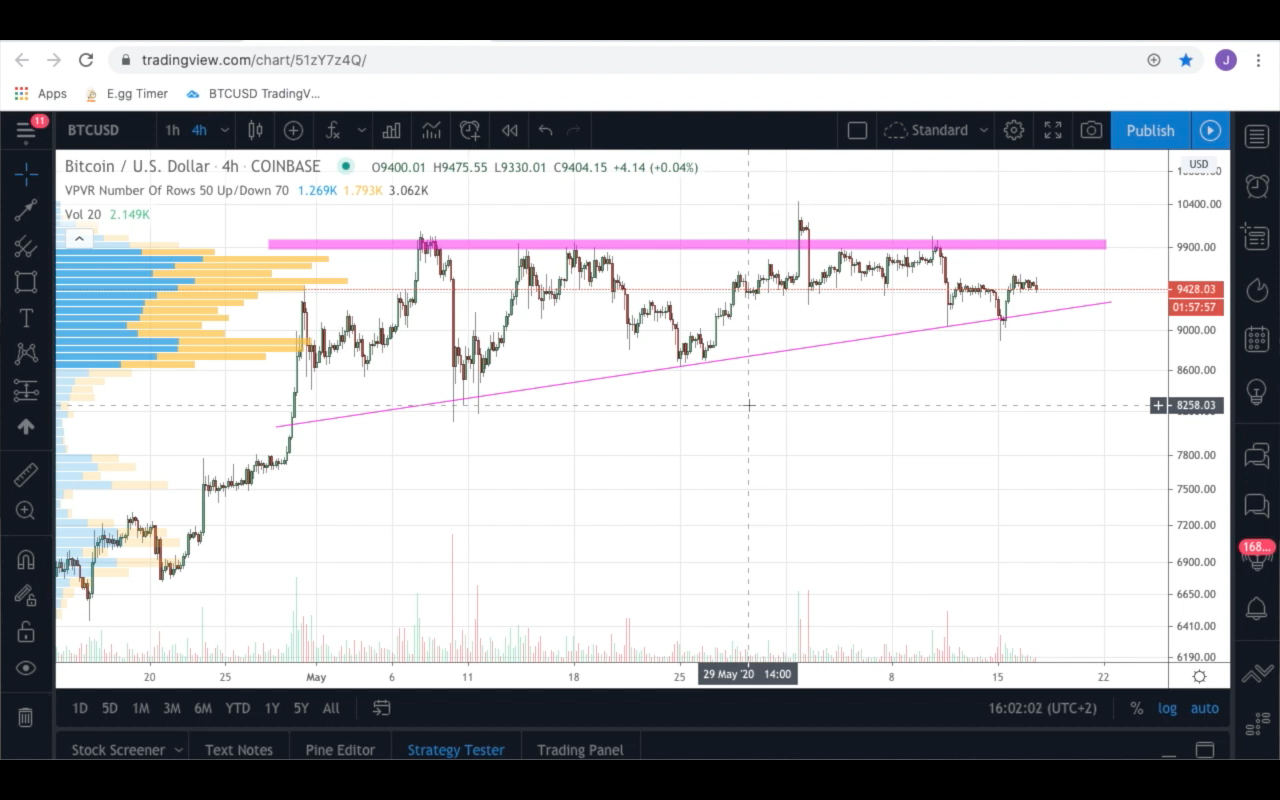

We’ve seen Bitcoin hovering in the $9000 range since early May, and while it has been volatile in this range touching $10,000 and dipping well below $9k, it would seem that this range is just dying to be broken, but which way is hard to call.

A break above $10,000, especially considering an apparent ascending triangle appearing on the short term chart, could be very bullish indeed:

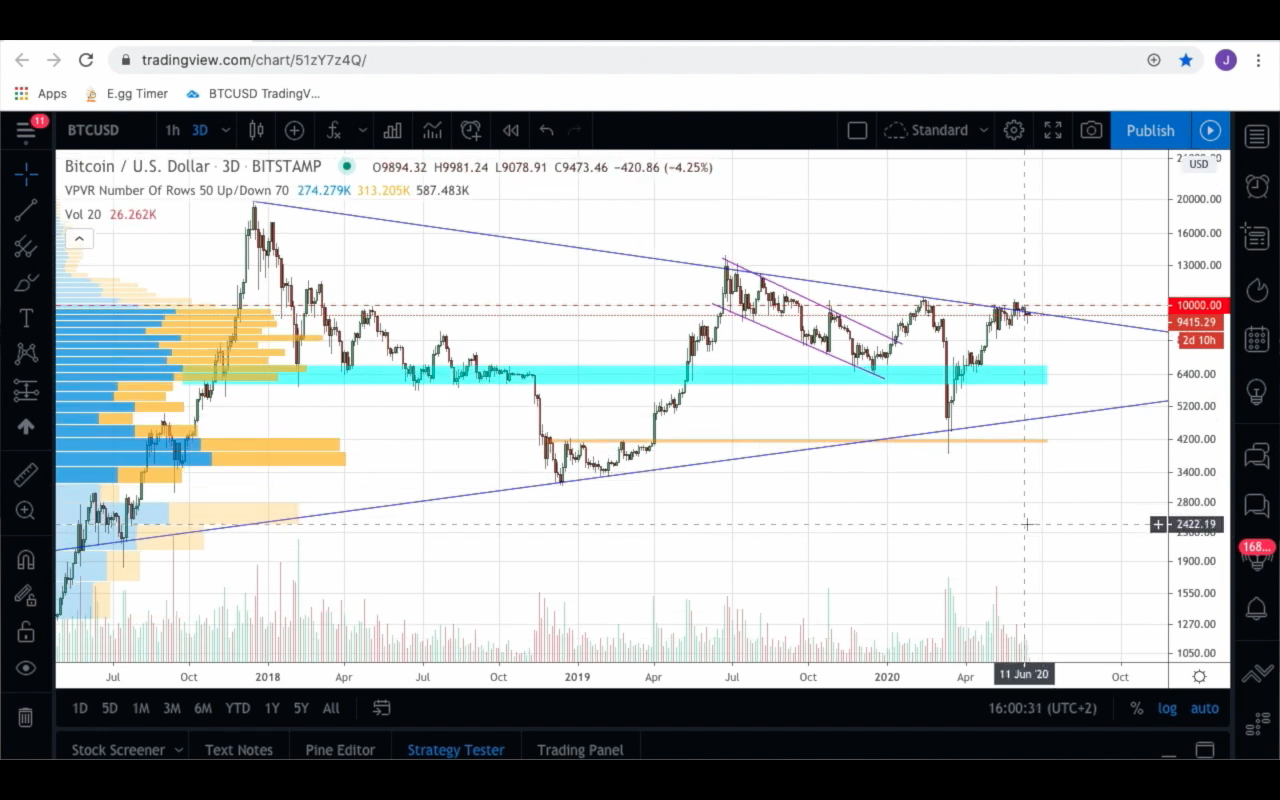

But conversely, the symmetrical triangle on the macro-chart makes a strong case for the price to return to the support trend line (bottom line of the triangle):

These two factors create equally strong cases, and thus keep Graeme at 50/50 as to whether he’s bullish or bearish right now, and because of this he isn’t trading Bitcoin in the short term.

The fundamental reasons just keep getting stronger, and coupled with that macro symmetrical triangle, we should see some significant gains in the next year or two, which is why he is happy to hold a long term position.

See Graeme explain his charts and understand his thinking in this week’s episode of Market Analysis:

Join Global Crypto’s Telegram Group here

And follow myself, James and Graeme on Twitter here.

See you next week.

Stay safe.

DISCLAIMER:

Global Crypto is not a registered financial advisory, and the information provided on this website and its subsidiaries is for entertainment & informational purposes only. Each reader is responsible for their own financial decisions, and Global Crypto cannot be held responsible for any decisions made by its readers and users. Global Crypto encourages all readers to consult a professional and registered financial advisor before making any financial decisions.