One thing we know is that our bias must remain fluid and be ready to change at drop of hat. The past couple of months have seen speculation reach all time highs, seeing glimpses of correlation between current price action and 2017 price action has the market on the edge of their seats’.

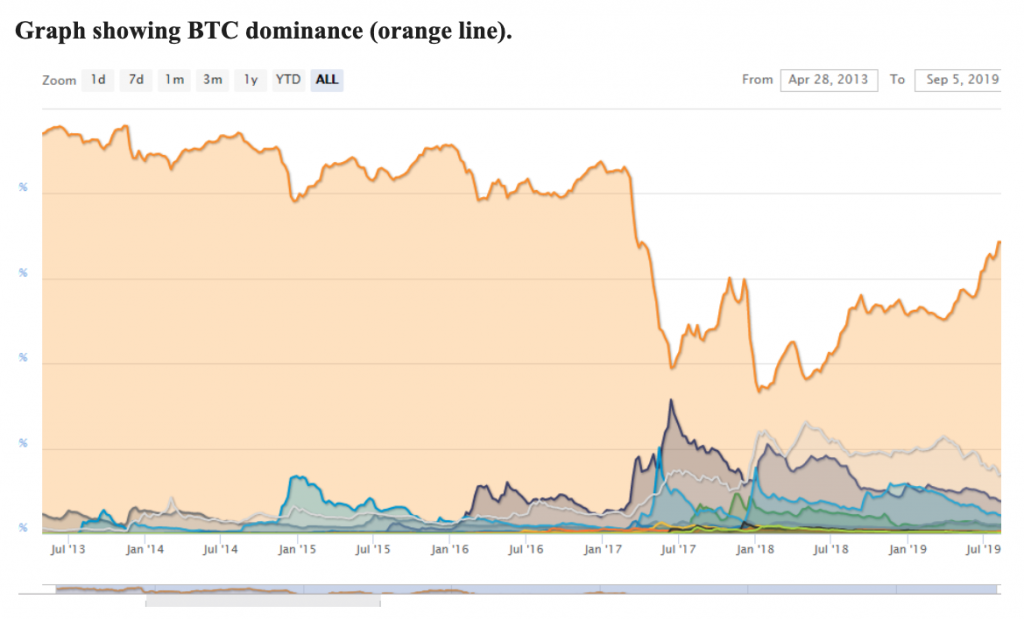

In the news we have Mark Carney in talks with Zucks over project Libra as the US continues turning their backs on his plans. Bakkt launches in just over two weeks and we are expecting huge liquidity in the market, potentially the catalyst we need to see this fairytale unfold and Bitcoin dominance is approaching some crazy levels, sitting at 70.8%. We also find ourselves in the middle of a global trade war and a broken Brexit situation. With tensions rising and all nations manipulating the market to some extent, we have seen Gold and Crypto, specifically Bitcoin, rally together. We continue to hear talks and concerns surrounding the US dollar and its long-term viability as a reserve currency and accessibility to cryptos is at an all-time high. So, where to from here?

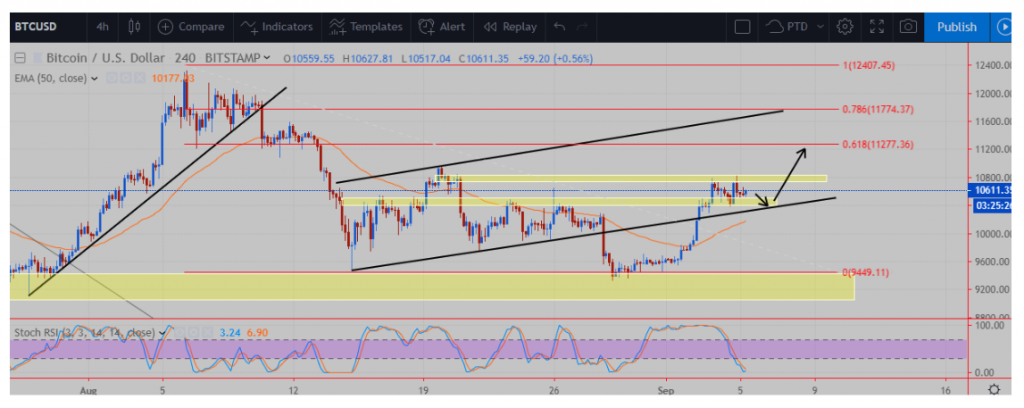

As you can see from the 4-hour chart above, last week we saw heavy selling pressure, completely obliterating our bottom trendline before dipping into our reversal zone and finding some buyers. This is the second time that the $9000-9500 mark has held as support, my view is that we have some nice fat whales lurking around these murky depths as their buy orders are triggered.

We now find ourselves back above our trendline and within our ascending channel again. If we can remain within this channel, potentially retest and hold that bottom trendline again we will see massive liquidity flowing into the market as the buyers start lining up. Buying pressure at this region would kick us off to fulfilling our 61.8% fib at the $11 200 mark.

My bias for the week remains positive and bullish, I feel that our next reversal will be around the $11 000 – $11 500-dollar mark as the big money drives all the FOMO buyers out of the market and sends us back down to retest our trendline which by then would be around the $10 600 – $10 750 mark.

Longer term, we have the BTC halving coming up in May next year. Basically, what this means is that it becomes twice as difficult to mine Bitcoin, rewards of mining are cut in half and by nature, the price of the coin will be driven higher as it becomes scarcer.

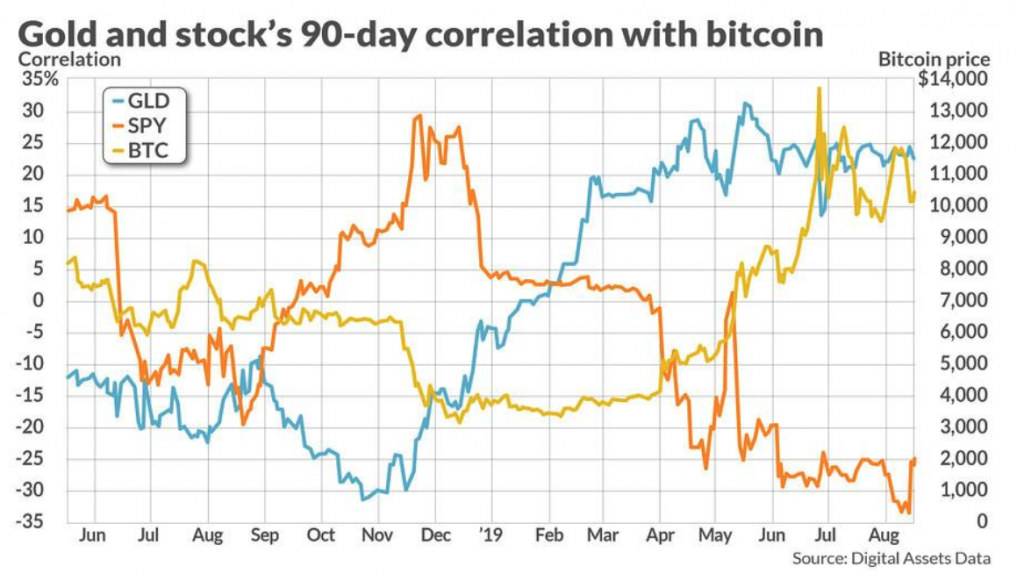

I personally believe that Bitcoin has the potential to run alongside gold as a safe haven in times of turmoil and the correlation below only adds to my confidence in this notion. I don’t think it would ever replace gold as a safe haven but it can most definitely keep up and substitute it in that regard. It is also very interesting to note the inverse relationship between Bitcoin, Gold and the stock market, clearly indicating the potential as a safe haven when business is bad.

As always, trade safe and remain fluid.

Until next time,

Jarryd