If the New York Attorney General is to be believed, Bitfinex entrusted $850 Million to Panama-based Crypto Captial (aka Global Trade Solutions A.G) and those funds are now “unavailable” for who knows how long.

Once the news broke, a friend working at a major crypto exchange confided in me that his exchange had funds with Crypto Capital for a short time, back in 2016, but got spooked by some of their practices and promptly got the “hell out of dodge”.

I’ve read many of the articles about Crypto Capital, and most seem to be working with 2nd or 3rd hand information. As I don’t have 1st hand information on the situation, this article will not attempt to analyze Crypto Capital’s failings or questionable practices.

This is more an exploration of the logic for having diversified banking partnerships, if you happen to operate in the Crypto space.

By way of example, PostRaise has a relationship with a similar-ish banking partner to Crypto Capital, although we open accounts in the names of our Crypto clients with the bank’s full knowledge that the businesses they are providing banking facilities to are Crypto businesses.

Even though this platform has many banking relationships in multiple jurisdictions, they are only one part of a multi-bank portfolio that PostRaise helps its clients to build.

The idea is to have a mix of bricks and mortar banks, online/neo banks, and private banks all in different jurisdictions with a mix of features, services, fees, base currencies, and so on. Again, all of these banks are aware of the clients Crypto related business.

This seems to be the opposite to the strategy Bitfinex opted for if the reports are accurate and we have seen where this has left them and their clients.

One incredibly important point to highlight is you should never “pretend” to be a non-Crypto business if you are one. It will only lead to a lot of work to get the account set up with an inevitable closure in a few months once the bank realizes that the wool was temporarily pulled over their eyes. It could also lead to your funds being frozen for months at a time when you need them most.

A much better strategy is to find banks who are more open-minded to working with Crypto businesses (they are out there, you just need to know where to look) and then to open at least 3–5 accounts if Fiat reliance is mission critical for your business model. Otherwise, 2 to 3 accounts is a “good enough” option for most use cases.

Redundancy in most industries is a dirty word but when it comes to Crypto businesses and their interaction with the Fiat world it can be rather sexy especially when it allows your business to survive an account closure.

Ari CIO of Block Tower Capital: sharing his view’s on Redundancy:

You might be thinking to yourself, I have a great relationship with my bank, they have been really supportive and helpful for the last X number of years, so why do I need to go through the time, effort and cost to get another one, two, or three, bank accounts?

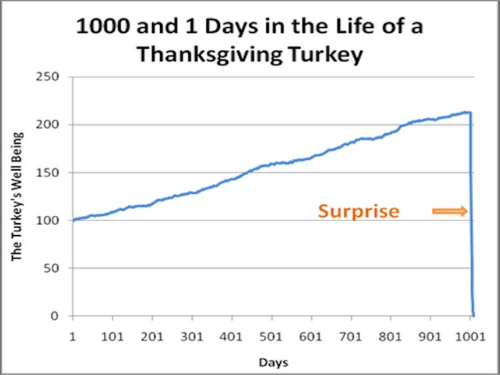

That’s a valid question and one which is answered here by my favorite author Nicholas Nassim Taleb.

“Consider a turkey that is fed every day,”

— Taleb writes.

“Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race ‘looking out for its best interests,’ as a politician would say.

On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief.”

You don’t want to be the turkey.

If the issue Bitfinex is facing can teach the Crypto industry anything when it comes to its relationship with the Fiat world, it is that relationships are tenuous at best and having all of your eggs in one (banking partners) basket is a recipe for unnecessary stress, reputational damage and possible loss of funds or the business itself.

As with all screw-ups, it better to learn from other’s mistakes not to make them yourself than have to clean up the mess. So let’s take this opportunity to learn from the $850m million “mistake”.

The message PostRaise has been preaching, since the beginning of 2019, is “safety in numbers” & “redundancy is sexy”. This can be achieved even in the Crypto space through the building of multi-bank, multi-jurisdictional Fiat Banking portfolios.

Republished with permission from PostRaise’s Sven Grensemann